How Will Inflation Impact Private Markets?

August 02, 2022

How resistant are private markets when it comes to inflation? Our experts examine how rates will affect decision-making and what could come next.

Inflation, Rate Hikes and Private Equity

The Federal Reserve’s July interest rate hike of 75bps, the second increase in as many months, will be felt throughout the private markets industry.

Both inflation and the associated rate increases impact private markets, as tightening global monetary policy increases the cost of capital – the lifeblood of the private equity industry.

Most noticeably, higher interest rates increase the cost of borrowing for leveraged buyouts, the industry’s bread and butter.

Funds that have relied on (historically cheap) packages of syndicated debt to supercharge returns on investors’ capital may find themselves looking elsewhere for drivers of value, keeping the barbarians waiting at the gate a little longer.

Compounding this, GPs will likely have to hand over more cash (as opposed to borrowed funds) when making investments to reduce counterparty risk to sellers.

Most underlying portfolio companies are also impacted by the increase in the cost of energy, labour and the supply chain issues often associated with inflation. However, not all industries are negatively affected, and certain sectors profit from inflationary pressures and consequent rate increases.

The real asset space fares well in inflationary environments, a concept explored later in this paper. Healthcare, consumer staples and technology have historically been positively correlated with inflation and Forbes’ Bill Conerly also notes that commodity prices rise disproportionately with inflation[1] with many GPs and Fund of Funds creating sector-specific vehicles to access these coveted asset classes.

The ability to quickly deploy vast amounts of dry powder and the diversification benefits offered by private equity and the wider alternatives industry mean investors are looking to increase their allocations.

Taking a Closer Look

GPs have been able to employ readily available cheap capital to fund multiple expansion as a source of value creation for investors. Purchase price multiples have been increasing steadily over time and inflation and consequent rate increases are sure to slow this down.

Looking at fully realized global buyout deals with more than $50m in invested capital,[2] for example, MacArthur et al note that the percentage of returns attributable to multiple expansion has increased from 48% to 56% from the period 2010-15 through to the period 2016-21.[3]

By contrast, the percentage of returns attributable to margin expansion has decreased from 14% to a slim 6%. Revenue growth as a source of return has remained a static 38% across periods.[4]

This prompts the question, if over half of the value created since 2016 has been fueled by low rates and easy money to fund multiple expansion plays, what is the next source of investment returns?

Commentators aren’t expecting titans of the alternatives industry to simply idle. But as prevailing economic conditions chip away at returns underwritten by cheap leverage, a manager’s stewardship and value creation strategy will be revealed.

The role of the general partner extends beyond financing into the realm of active management, and managers prioritizing margin expansion and revenue growth are likely to be the winners as inflation hits and interest rates rise.

Creating Value

Whilst a skew towards multiple expansions very much exists; it is fundamentally within private equity firms’ nature to generate value in their portfolios through operational improvements in the companies they own – a great example found in a 2004 electronics buyout.

Shortly after completion, the GP sought out instant value creation by initiating a full product line review, cutting ailing arms of the business, bringing margins up to industry standards, and managing working capital more aggressively. This generated significant cash flows in the first year, according to Moonfare.[5]

Within three years of the purchase, all acquisition debt had been cleared, and the GP sold 50% of its shares for €1.4 billion, a 10x multiple. The company was then taken public in 2010 to round off a big win for all involved.

This evidences the value to be generated through a calculated and determined operational improvement strategy, without a reliance on pure leverage driven expansion.

Building on Success

As successful as the ‘buy and improve’ strategy has proven for the industry, ‘buy and build’ has also become a go-to approach for private equity firms.

This sees firms making various acquisitions in addition to their initial investment, with the aim of creating higher returns as a result.

The reason buy and build can be so lucrative for firms is because it offers numerous routes to achieving revenue growth – improving market positioning, expanding both geographically and in product base, as well as synergies gained through economies of scale – all of which can be reached at a quicker rate than through organic growth and, if executed correctly, will result in the whole being worth significantly more than the sum of its parts.

Firms are well-placed to direct record-levels of dry powder towards ‘bolt-on’ acquisition strategies.

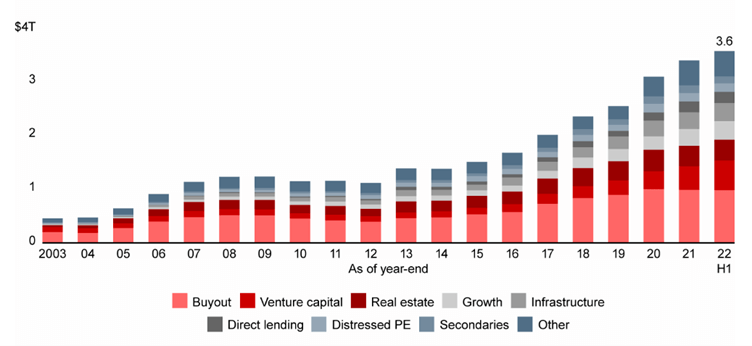

Global Private Capital Dry Power, by Fund Type

Source: Bain Capital

Cause for Optimism?

Buy-and-improve as well as buy-and-build strategies provide tangible paths to value creation, showing there is more cause for optimism within the private equity industry.

In Lionpoint’s view, protection from public markets through lagged valuations and longer-term investment horizons also serve as reasons why the industry is set to remain level-headed at present.

As far as protection is concerned, the degree of correlation between private and public markets is hotly contested (and not subject to debate here), but there are clearly differences between the two asset classes. These include listing status, perceived and actual levels of liquidity, sizes of interests, length of investment horizon and diversification benefits. Beneficial attributes that are peculiar to the private equity industry should hold true in both bull & bear markets.

Another key difference is transparency; the differing levels of visibility afforded to investors regarding underlying company financials and performance.

The decision to buy or sell in public markets is not just driven by earnings releases, but also business and sector news, press releases, and the (inter)activities of other investors. As iCapital’s Dan Fletcher and Nick Veronis point out, public assets are impacted by investor sentiment[6] – fear, and greed – which contribute to fluctuations in listed markets.

Comparative illiquidity of the private markets does play a role, being less susceptible to the sell-runs and market recalibrations that an inflationary environment prompts in the public sphere. A more interesting observation, however, is the relationship between pricing & sentiment.

In public markets, pricing is always reflective of sentiment, and sentiment is similarly reactive to pricing, with no obvious break in this feedback loop. A natural break exists for private equity investors, where valuation cadence and latency provide breathing space for private markets to uncover true value.

The number of inputs used to value private assets, as well as data availability hurdles surrounding valuations, see NAVs cut on a quarterly basis and on several week delay at best.[7] On one hand, this is sure to make a few LPs nervous amidst economic uncertainty, but it also affords GPs time to strike the right tone in investor reports and assure investors of the vision for long term performance.

Investors are admittedly strapped into the J-curve, but they can enjoy the ride.

Alternatives to Alternatives

The alternatives industry extends far beyond private equity, into private credit, hedge funds, and real assets. Intangibles too are gaining increasing traction, with funds emerging to target intellectual property, broadcasting rights for sporting spectacles, and the back-catalogues of legendary performers.

Real assets include commercial and residential real estate, natural resources, commodities, and infrastructure, with the latter covering (at least) transportation, telecommunications & utilities. REITs, publicly traded vehicles, are also worth a mention as a liquid alternative providing exposure to various categories of real estate.

Amidst the alternatives on offer, real assets are often held out as the gold-standard inflationary hedge, but this does warrant closer inspection.

The Case for Real Assets

First and foremost, yield-ripe real assets can serve as an alternative to investing in fixed income.

As interest rates rise, returns on fixed income instruments can become less attractive and the value of a fixed income portfolio can decrease.

Real assets, however, benefit from the variability of underlying rates in line with inflation.

Private Equity Wire note that infrastructure assets, which may rely on long-term governmental contracts and concessions to operate, can pass inflation on to customers through increased tariffs.[8]

This is not dissimilar from the way lease renewals and rent reviews function in the real estate sector, to constantly mark rates to market. According to Avison Young, leases may also include explicit annual indexation of rents to some specified measure of inflation, or pre-set step-ups in rents over the term of the lease.[9]

Real assets are not just income-generating assets and investors often expect capital growth as part of their total investment return.

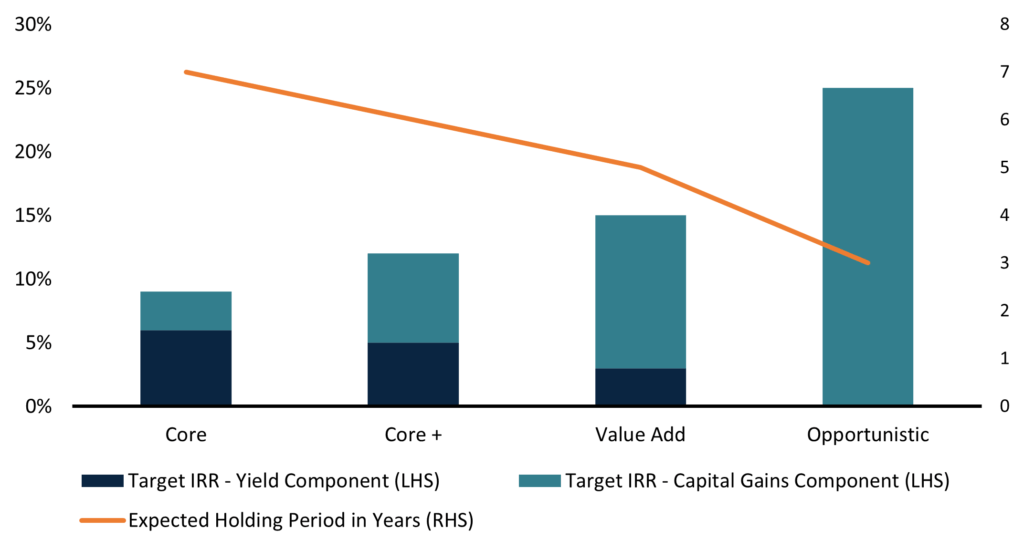

Within real assets, the infrastructure asset class can be broken down into Core, Core Plus, Value Add and Opportunistic strategies, with target IRRs ranging from 6% to 15%+[10].

Infrastructure Investment Characteristics

The yield element is the highest within Core infrastructure, as such, a portfolio of Core infrastructure assets, held for 7+ years, provides inflation adjusted cash flows across economic conditions.

Of course, 7+ years is no insignificant stretch of time in which to lock up capital.

Mission IPO-ssible?

Setting aside the recent uptake of both GP- and LP-led secondary transactions,[11] an investor’s exit from any given investment is driven by the manager’s intended point of departure.

In the case of private equity, this will often take the form of an initial public offering, or IPO – releasing (or perhaps even returning) an asset to the public markets, and the tides of investor sentiment.

With public markets in disarray, it is safe to say that now is not the time for most PE-backed companies to list, and the IPO market certainly reflects this.

Globally, the value of IPOs has dropped 71%, from $283bn to $81bn, over the last 12 months, and the number of listings has fallen from 1,237 to 596, according to the FT.[12]

So, can GPs just wait current market volatility out?

Inigo Esteve, Partner at White & Case, certainly thinks so. Esteve, who advises companies on IPOs, has said that he expected many would postpone until next year at the earliest, asking “why would you launch now when you could wait for better conditions?”

But when will these better conditions arrive?

Turning to the UK, Andrew Bailey, Governor of the Bank of England, said in a speech to the Official Monetary and Financial Institutions Forum that “the Committee will be particularly alert to indications of more persistent inflationary pressures, and will, if necessary, act forcefully in response.”

It has been made clear, for example, that a rate hike of 50bps could be on the table for this September, however, economists believe these hikes will be short-lived once the increases begin to quell the current price pressures.

Predicting inflation and the effect of monetary policies upon it is extremely difficult, but the Bank of England is perhaps best placed to do so when they note that “the rate of inflation is forecast to keep rising this year” but that it is expected to slow down next year and “be close to 2% in around two years.”[13]

In this case, it is expected that the hundreds of companies and PE firms waiting for the IPO market to reopen, will sit tight for at least another 12 months.

One thing for certain is that the appetite to take companies to market has not disappeared, and that once things stabilise there will be a flurry of activity, “even if it does not reach last year’s levels”, according to Jenner & Block partner Martin Glass[14] .

Whilst the time it will take to return to the record IPO levels witnessed in 2021 is not so obvious, the fact that the hunger is there amongst the industry is.

Case in point then, there remains strong appetite for fit and profitable companies in the public markets, and managers that have nurtured excellent businesses are poised to deliver.

Where to go from here…

The GP plays a two-sided role in the investment landscape. As financiers, GPs must contend with rate hikes and their effect on the cost of borrowing. As stewards of investments, GPs must manage both the challenges and opportunities which an inflationary environment presents to each portfolio company.

As stewards, GPs can apply tried and tested ‘buy and improve’ and ‘buy and build’ strategies to extract real value from investments. This, as well as protection from the public markets, lagged valuations & longer-term investment horizons all serve as reasons why the PE industry is poised to remain buoyant at present.

The longer-term fund structure of the private equity industry provides GPs with somewhat of an inflation buffer. Where listed companies are required to report quarterly earnings to be torn apart by the short-term profit requirements of public market investors, PE-backed companies have greater flexibility and thus opportunity to problem solve.

This is a significant advantage in today’s uncertain environment, and GPs can capitalise on this through traditional forms of value creation, using their skills, tools, and ability to outperform the market.

It is also important to remember that the alternatives industry is far reaching, and general partners have a variety of private equity, private credit, hedge fund, and real asset solutions available to safeguard investor interests in today’s climate.

In Lionpoint’s view, the private markets space is well-positioned to weather this storm.

[1] https://www.forbes.com/sites/billconerly/2021/06/29/the-industries-that-will-be-helped-and-hurt-by-inflation/?sh=bce4a7f5fe30

[2]Excluding RE & infrastructure deals, by median value creation and year of exit.

[3] https://www.bain.com/insights/inflation-global-private-equity-report-2022/

[4] As above.

[5] https://www.moonfare.com/blog/5-examples-pe-value-creation

[6] https://www.icapitalnetwork.com/insights/private-equity/how-private-market-valuation-methodologies-help-temper-volatility/

[7] As above.

[8] https://www.privateequitywire.co.uk/2022/05/06/314372/why-inflation-fears-are-lifting-infra-funds

[9] https://www.avisonyoung.com/en-GB/is-real-estate-an-inflation-hedge

[10] https://www.mercer.com/content/dam/mercer/attachments/global/gl-2021-infrastructure-a-primer.pdf

[11] More from Lionpoint on this, here: https://lionpointgroup.com/insights/a-secondary-wind-why-the-secondary-market-is-surging-in-private-equity/

[12] https://www.ft.com/content/bc96ce22-8065-4be7-b577-5ba9ba225568

[13] https://www.bankofengland.co.uk/knowledgebank/will-inflation-in-the-uk-keep-rising

[14] https://www.ft.com/content/bc96ce22-8065-4be7-b577-5ba9ba225568