A Second(ary) Wind: Why the Secondary Market is Surging in Private Equity

April 06, 2022

Secondary funds had their biggest year ever in 2021 as buyers and sellers both came to the market in droves, a trend set to continue through 2022 and beyond

The perfect storm for private equity’s secondary markets to surge is taking shape.

Record levels of dry powder, liquidity pressures, new vehicles designed to focus on quality assets and a burst of data driven advances in technology are driving tremendous volume with no signs of slowing down.

What is the Secondaries Market within Private Markets?

Public securities are created in the primary market via an IPO or rights issue then traded on the world’s stock exchanges in the secondary market.

Private markets work in much the same way but with the added complexities that come with being illiquid.

Primary private equity funds use commitments from LPs (limited partners) to fund investments in unlisted companies. LPs commit funds on the basis that a fund manager will make a profit and return more than they invest. As LPs don’t know which companies a fund manager will be buying, this is known as blind pool capital. Primary funds can ask investors to commit capital for seven years or more and it is this illiquidity that necessitates the existence of the secondary market.

A private equity secondary fund purchases existing positions in PE funds or unlisted companies to realise some of the gains and provide LPs with early liquidity.

Early liquidity isn’t the only driver behind trading on the secondary market. Regulation plays a part, but active portfolio management in rebalancing exposures or creating new vehicles to hold on to quality assets is increasingly credited with causing the uptick in secondary trading volumes.

Shorter J-curve effects and investment periods, diversification through purchasing stakes in multiple funds and reduced blind pool risk all contribute to making secondary funds an attractive and profitable asset class.

Record Capital, Record Activity?

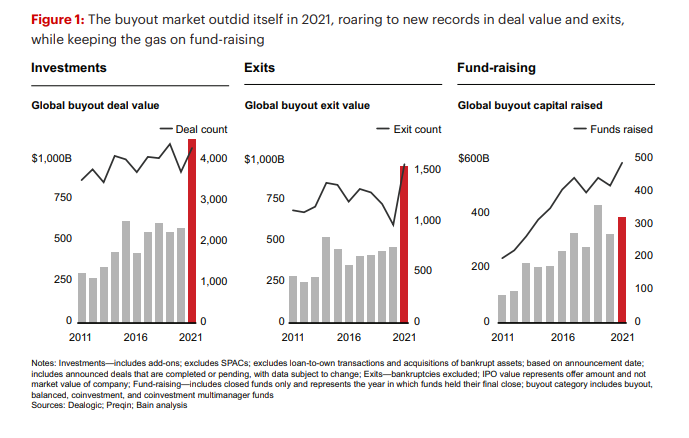

Courtesy of Bain Capital

The long recovery from the global pandemic kicked into gear in 2021 for private equity with $1.1tn of buyout activity, doubling the understandably slow previous year and beating the 2006 record by 40%, according to the latest Bain Private Equity Report. PE firms raised bigger funds, made larger deals and came to market more frequently, a trend that is set to continue into 2022. These dramatic increases in primary investments have created an even larger pool for secondary fund deal sourcing.

Fundraising hit record levels of $1.2tn (up 14% on 2020) adding to the $3.4tn of global dry powder (the amount of committed but uninvested capital) in the industry. It is this huge volume of capital that is putting pressure on GPs to put money to work and fueling the volume of secondary transactions.

Liquidity Drivers

Floods of COVID stimulus from governments around the world drove asset prices up and led to a frenzy of exit activity in 2021. Secondary sellers realised investment performance and created liquidity while buyers saw residual value in portfolios and snapped up assets despite those higher asset values reducing discount to NAV (Net Asset Value) on purchase prices.

As political developments in Ukraine and the threat of globally higher interest rates result in choppier markets, IPOs are likely to become a less attractive exit option. Coupled with continued dry powder pressure, this will drive further secondary market trading.

A New Focus on Continuation Funds

The traditional model for secondary investments has involved one LP looking to purchase the private equity interest of another with the approval of the GP (general partner).

A continuation fund is a type of GP-led secondary where a new investment vehicle allows a GP to hold on to assets with enduring value beyond the typical period, bringing some of the LPs from the original fund along and attracting new investors.

GP-led secondaries deal volume hit $68bn globally in 2021, an almost 100% increase from 2020 and at least a third of the top 50 GPs in PEI’s ranking of the top 300 biggest industry fundraisers currently make use of them.

Part of the recent popularity is due GPs wanting to hold on to trophy assets and part due to market dislocations caused by the global pandemic which meant that portfolios may need more runway to realise investment value however, Evercore data has shown this trend is set to continue as 29% of secondaries buyers intend to focus on continuation funds, up from 26% in 2021.

Using Technology to Sharpen Secondary Deal Data

Pricing secondary deals has been one of the major sticking points for new secondary market entrants. PE houses with large primary holdings have the advantage of visibility into funds where they have existing investment, however asset-level NAV coverage when pricing a transaction varies significantly from deal to deal.

Larger quantities of higher quality data with far greater breadth now exist from both traditional suppliers of PE data like Preqin, Refinitiv, DealCloud and Cambridge Associates, to alternative data sources like news articles, broker reports and online search trends.

There have been significant improvements in the areas of data collection and screening from a wider variety of sources than ever before. Technology platforms like Chronograph, Cobalt, Evolution.AI and Freyda have emerged to compete with established offerings from eFront and IHS Markit who have continued to innovate within the space.

Technology and data improvements are easing the way to a more efficient, less relationship-driven space with lower barriers to entry. But the pace at which fund managers adopt advanced data and analytics tools could go a long way towards determining who comes out on top.

2022 and Beyond

Attractive returns, lower barriers to entry, sufficient dry powder and expertise to capitalise on new opportunities is causing an influx of new market entrants in the form of pension plans, sovereign wealth funds, primary focused PE firms and traditional asset managers. All these parties have found a need to build out their own secondary investment platforms.

These new players bring their own capabilities and specialisms meaning the asset class is expanding to include non-PE assets like credit, core infrastructure, sustainable investments and fintech, which will help create new transaction structures.

Recognised secondary investors have strengthened their own positions through acquisition with CVC’s purchase of Glendower, PGIM’s acquisition of Montana Capital Partners and Franklin Templeton of Lexington Partners.

2021 is set to be the biggest year on record for secondary trading as estimates of deal volumes vary from $100bn to $140bn over the next 12 months and $250bn within 5 years from $71bn in 2021, according to PEI. Both LP- and GP-led secondary investment is set to continue with 86% of LPs in Coller Capital’s survey expecting growth to be maintained over the next 3 years.

Mergers, acquisitions and expansion of existing capabilities all have a direct impact on a firm’s operating model. Effective change management involves people, process, technology and data, and is crucial to ensuring the successful deployment of any strategic plan and operational transformation.

How Lionpoint Can Help

Lionpoint is a leading global consulting firm delivering operations transformation and technology enablement solutions to the alternative investments market.

Lionpoint’s consultants have domain expertise across private equity, real estate, infrastructure, and private debt. Its core services include strategic advisory, operating model optimization, technology roadmap and solution selection, and systems integration to solve the complex operational and technology challenges across the front, middle, and back office.

For more information, contact us here.