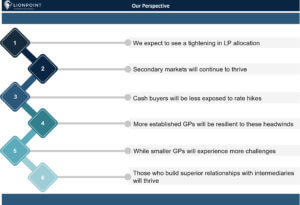

Lionpoint's Private Markets Advisory Team shares six predictions for the private equity space for 2023 and how to best assist GPs

Our perspective: Limited Partner right-sizing and dry deal flow present challenges to smaller private equity firms. However, they can succeed by tapping into sources of differentiation and identifying which parties consistently deliver winning deals.

Six Predictions

- Distribution slowdown and the denominator effect will exert pressure on LP liquidity and allocations. We expect LPs to turn to secondaries to right size portfolios and free up capital for a coveted 2023 vintage year. Whilst this will benefit secondary markets, we expect to see fundraising difficulties.

- On the other side of the secondary market, we expect sub-optimal IPO conditions to sustain interest in GP-led transactions and continuation funds (subject to some nuances surrounding valuations).

- The cost of capital is high, and so we also expect to see GPs pulling back from Leveraged Buyouts, though those firms who can pay cash will do so.

- Likewise, we predict that larger, diversified GPs will home in on their yield-generating businesses, such as Credit & Real Assets.

- With portfolio companies changing hands less regularly, and market conditions favoring larger, diversified GPs, securing strong deal flow (whilst maintaining pricing discipline) will remain a top priority for smaller PE firms. Their win-rate, track record, and sources of differentiation will all also factor into LPs’ right-sizing assessments.

- In our view, entrenched banking relationships and a network of region-focused placement agents will be vital for both deal flow and fundraising this year – Particularly for the smaller shops.

If you would like help navigating the future of private markets with experienced consultants such as Matthew, fill out the inquiry form below to get started