Real Assets Technology Strategy Part III: Actionable Insights, Turning Data into Wisdom

March 28, 2023

If organizational data is to be viewed as an asset, how can Real Assets organizations realize and maximize the intrinsic value of their data assets?

(Editor’s Note: This piece is the third of a three-part series published by Lionpoint’s Real Assets team.)

Read Part 1: Leveraging Data & Technology to Drive Real Results in Real Assets

Read Part 2: Implementing for Change

Part 3 – The Holy Grail: Actionable Insights – Turning Data into Wisdom

As the Real Assets industry has increasingly turned to technology solutions to increase operational efficiency, store organizational and market data, as well as reduce enterprise risk, Real Assets organizations find themselves wading in a sea of disparate, siloed systems that have fragmented access to data like never before. This challenge has been exacerbated by the trending return to best-of-breed technology strategies.

For Real Assets professionals, the question has evolved from not having a system in which to collect and manage data, to not knowing which system holds the golden record for a given piece of information.

“For Real Assets technologists, an integrated architecture that is agnostic to underlying transactional systems has become pivotal to providing a more streamlined end-user experience in which business users can access more information via fewer touchpoints,” states Lionpoint Executive Director and Real Assets Service Line Lead for North America, Naseem Wenzel.

Underlying these challenges is the increasing requirement across the Real Assets industry to more fully leverage data to drive decision-making. For example, according to PERE News, any attempt at ESG targets starts with healthy and accurate data. If organizational data is to be viewed as an asset, how can Real Assets organizations realize and maximize the intrinsic value of their data assets?

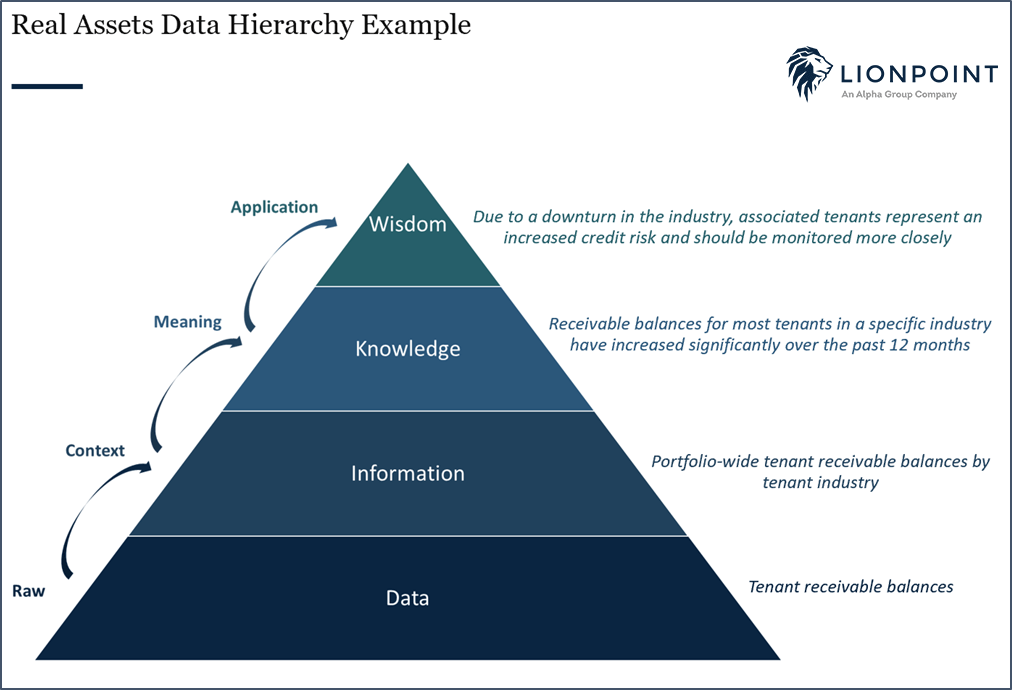

The key to unlocking the value of data is to travel up the data pyramid from raw data to information to knowledge to wisdom. Extracting wisdom from data is the holy grail for modern companies across the globe, in a world in which data has become the new intellectual currency.

While the Real Assets industry is fairly skilled at using data to look backward, it is still in the infancy of being able to leverage that historical data to anticipate the future, and therefore inform decision-making. For today’s Real Assets organizations, the critical advancement that can propel the use of data to drive competitive advantage from theory to practice is the design and implementation of a solid Data Platform. An optimized Data Platform facilitates the management, aggregation and analysis of enterprise data across disparate internal and external sources.

Real Assets Data Platform: Data Management & Aggregation Capabilities

Given the fragmentation of the data landscape within most Real Assets organizations, the first capability that a Data Platform should offer is the ability to manage and aggregate data. Clients often ask: “Is it better to build or buy? Do I need a Data Warehouse, a Data Lake or a Data Lakehouse?”

However, the operating models, investment strategies, data sets and technologies at work within an organization are unique. There is no one-size-fits-all platform design that can or should be deployed across the board. Rather, data management and aggregation capabilities should be delivered with the specific business and technical requirements of each organization in mind:

What is the size of the organization?

What data sources need to be ingested/integrated?

At what frequency do various data sets need to be refreshed?

What is the integration strategy?

What data quality rules need to be applied?

In evaluating whether a Data Platform meets business and technical requirements, a key question to consider is whether the platform can effectively overcome the inherent complexities in aggregating Real Assets data through:

- Master Data Management – Essential to maintaining a golden record for all foundational data (properties, tenants, etc.) and for accurately combining data sets from disparate systems and sources.

- Data Validation and Quality Checks – Critical components of governing data to ensure its quality and reliability.

- Data Normalization – Facilitates the organization and consistency of data, as well as establishing the relationships between data elements.

If designed and deployed correctly, the data aggregation layer should become the data source that once validated and ingested cannot be further transformed by end-users.

Real Assets Data Platform: Reporting, Analytics & Enterprise Intelligence Capabilities

With data management and aggregation capabilities having been considered, the other key components of the Data Platform relate to the ability for business users to access and make use of data via reporting, analytics and enterprise intelligence capabilities. Again, selection of the supporting technology(s) that best delivers these capabilities hinges on defining business and technical requirements pertaining to data access and consumption. Organizations should consider both internal and external information delivery requirements and the purpose or use of the information as part of solution selection and design.

In terms of information delivery, organizations need to understand how end-users expect to interact with the information – via a static report? via an interactive dashboard? via a data extract? It is essential that these discussions challenge business users to think beyond conventional norms and behaviors for data access, as organizations industry-wide are littered with reports that no one seems to read and dashboards that no one seems to use.

Additionally, explicitly defining how data will be used helps to ensure that organizations are focused on data and analytics that drive business activities and decisions, avoiding the temptation to procure and provide data that does not have a purpose. Organizations need to think critically about the metrics that matter and the types of analysis that can impact business performance.

“Rationalizing, modernizing and prioritizing information delivery requirements and defining the purpose for data are key to defining a reporting and analytics scope that is both achievable and delivers business value,” Wenzel said.

Turning Data into Wisdom: Success Factors & Considerations

Now for the hard part. The reality is that most Real Assets data projects tend not to meet business stakeholder expectations. This happens for a variety of reasons, which often have less to do with technical capabilities and more to do with preparation and approach. Some of the key success factors that can make or break the implementation of a Data Platform include:

- Data Strategy – Defining an organizational data strategy is critical to becoming data-enabled. Understanding what data is important and how it will be used provides a tangible rubric for measuring the success of the platform. (more in Part 1)

- Data Governance – A robust data governance program ensures the availability and usability of high-quality, trusted data for the platform to consume. It also designates a single source of truth for each data element and prevents ad hoc transformation of data across disparate data sources/silos. Ideally the data governance program is underpinned by an organization-wide data culture that values data as an asset. (more in Part 1)

- Technology Strategy – Defining a comprehensive technology strategy enables the collection and storage of data within structured systems that can act as key sources of truth for the platform, as well as the automation of integration from data sources to the platform. (more in Part 2)

- Platform Design – Perhaps the most important design principles for a modern platform are flexibility and elasticity. The pace of change within both the business and technology environments requires Real Assets organizations to be able to adapt and innovate at scale and with agility.

- Implementation Approach – The universe of Real Assets data is large and expanding, so the approach to prioritizing and onboarding data sources to the platform significantly impacts speed to market. Defining and delivering prioritized use cases can demonstrate business value and build trust and momentum for additional implementation cycles.

- Support Model – As technology needs and solutions evolve, the capabilities required to support those technologies should be reconsidered. This is especially true for a Data Platform, where the industry’s technologists need to be more business-savvy, business users need to be more technology-savvy, and the two need to work in close collaboration to achieve success.

WealthManagement.com calls this adoption of new data technology the “Moneyball Era” of commercial real estate, referencing the film about baseball analytics to make a larger point about those who successfully leverage these tools, ultimately coming out on top.

While there is a temptation to get excited (and distracted) by the more advanced and attractive buzzwords associated with data science and emerging technologies, Real Assets organizations are still working to build the foundations that will allow them to crawl toward data accuracy and availability before they run toward prescriptive analytics. A robust and well-designed Data Platform is a key component of the toolkit that will enable organizations to manage and democratize their data so that their people can turn that data into wisdom.

If you would like to better understand or develop your organization’s ability to manage and aggregate data to produce actionable insights, Lionpoint has a team of consultants specializing in Real Assets with deep experience selecting, designing, developing and implementing Real Assets Data Platforms.

For North American organizations, please contact Marlena Badway at mbadway@lionpointgroup.com, while Europe-based firms should email Hannah Holt at hholt@lionpointgroup.com.