Leveraging Data & Technology to Drive Real Results in Real Assets: Part I

November 03, 2022

Whether managers are focused on building resiliency to weather market instability, attracting new sources of capital, or demonstrating a strong ESG record, data is at the center of the strategies that will be required to address these critical goals.

(Editor’s Note: This piece is the first of a three-part series published by Lionpoint’s Real Assets team.)

The Real Assets industry is at an inflection point in its evolution. Pressures to innovate and better leverage data and technology have reached new heights with all stakeholders (investors and junior analysts alike) less willing to embrace the status quo, which has long been characterized by:

- Spreadsheet-driven data management and reporting

- Limitations aggregating often incomplete data residing in siloed systems and functions

- Lack of governance to establish consistency and confidence in data

- Manual processes lacking standardization and transparency

- Complex, fragmented technology architectures

- Reluctance to adopt new technology due to poor change management

This series, published by Lionpoint’s Real Assets team, offers a perspective on how to turn these challenges into opportunities to catalyze scalable growth. It will explore:

- Real Assets Data Strategy: Is Data Driving or Drowning Your Business?

- Real Assets Technology Strategy: Implementing for Change

- The Holy Grail: Actionable Insights – Turning Data into Wisdom

Part 1 – Real Assets Data Strategy: Is Data Driving or Drowning Your Business?

Among the challenges confronting Real Assets owners and investors, the ability to harness and leverage data has perhaps the greatest potential to permanently impact the competitive landscape. Whether managers are focused on building resiliency to weather market instability, attracting new sources of capital, or demonstrating a strong ESG record, data is at the center of the strategies that will be required to address these critical goals. Therefore, coming out on the right side of the data divide will be critical to remaining competitive: can one transform their business from drowning in the acquisition and management of data in order to unleash the power of data to drive better, faster decision-making?

Lionpoint’s experts believe the starting point for crossing this divide is to establish a shared understanding of the value of data. When firms start to view information as an asset, akin to a tangible real asset, it is easier to appreciate not only the need to nurture and develop the asset, but also the potential return on properly managing and investing in this asset.

Simply put, investing in information as an asset produces returns such as better and faster decision-making, as well as the ability to leverage that information as a source of competitive advantage.

Real Assets Data Capabilities

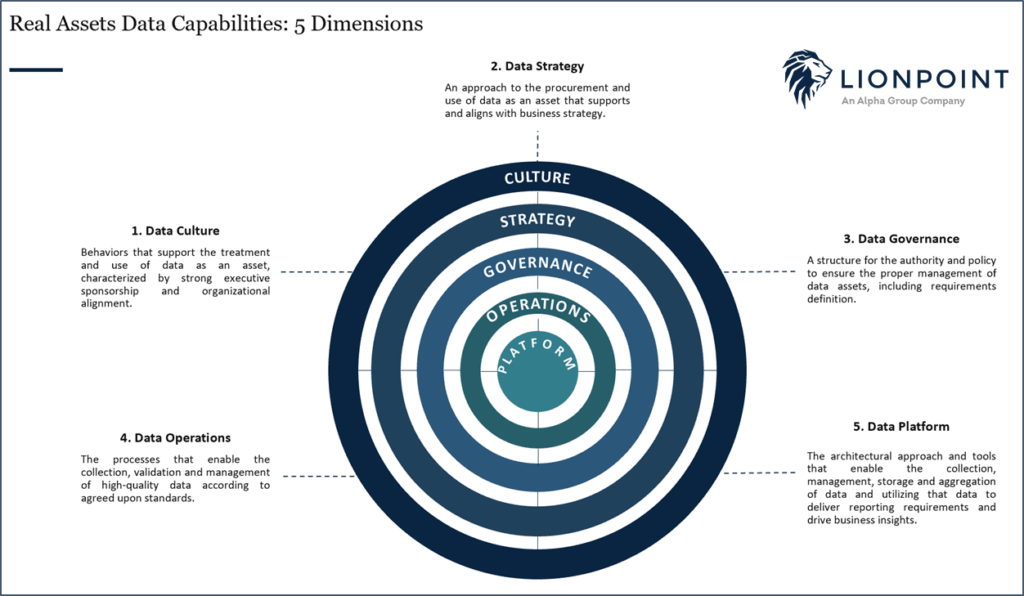

To build a robust data program, a Real Assets organization should invest in developing the following data capabilities: Data Culture, Data Strategy, Data Governance, Data Operations and Data Platform.

“Data Culture is the most critical of these capabilities,” states Lionpoint Executive Director and Real Assets Service Line Lead for North America, Naseem Wenzel. “Data Culture means that an organization has established both the mindset and the behaviors that regard data as an asset, which is a necessary foundation for building the other data capabilities.”

Any skilled Portfolio or Asset Manager will tell you that the key to maximizing investment returns is a sound asset strategy. The same is true for data.

Alignment on goals and objectives for an organization’s use of data, and clear articulation of these aims in the form of a defined Data Strategy, is the next step in building a data program. From there the supporting Data Governance, Data Operations and Data Platform required to support realization of the strategy can be constructed.

This graphic and its contents are the intellectual property of Lionpoint Group and may not be replicated or disseminated without the expressed written consent of Lionpoint Group or Alpha FMC.

Real Assets Data Complexities

So if the formula is that simple, why haven’t organizations industry-wide cracked the code just yet? While there are a number of factors at play, one of the most significant is that the Real Assets industry is not monolithic. It is a highly-diverse and constantly-evolving business, and therefore a one-size-fits-all approach to anything, let alone something as multifaceted as a data program, is far from practical. For example, because of the depth, breadth and variability in Real Assets data, a standard Real Assets data model still has not been adopted (though organizations such as OSCRE are making great strides in providing a common framework). Therefore, a carefully tailored design for a data program that considers the following industry complexities, among others, is more appropriate and likely to deliver tangible results:

- Operating Model – Are Real Assets activities vertically integrated with your organization, fully outsourced, or a hybrid?

This influences who creates and transacts data.

- Investment Strategy – Is your organization directly or indirectly invested in Real Assets? Is your organization invested in core or value-add assets? This influences the level of data required/collected and the frequency with which it changes.

- Asset Class – What types of Real Assets comprise your organization’s portfolio? What types of Real Assets might comprise your portfolio in the future? This influences what types of data required/collected.

- Jurisdiction – In which geographies/jurisdictions is your organization operating? What are the jurisdictional requirements? What are the local business practices? This influences where, how and why data is created.

Based on the answers to these questions, an organization can better identify its specific data opportunities and requirements, as well as the individual competencies, processes and technologies required to support its data capabilities.

Data Program Success Factors & Considerations

With an appreciation for the capabilities and complexities that need to be considered in building a data program as a starting point, the final pieces of the puzzle are intangible factors that drive the success of these programs. [Read: Many organizations have failed to develop successful data programs because these factors were not properly considered.]

- Sponsorship & Support: Data programs should be business-led and IT-enabled with strong executive sponsorship and participation.

- Flexibility & Scalability: Data programs should be designed with flexibility and scalability in mind to support growth and change.

- Organizational Culture: Data programs should be designed with the context and culture of each organization considered to ensure stakeholder buy-in and alignment with core values.

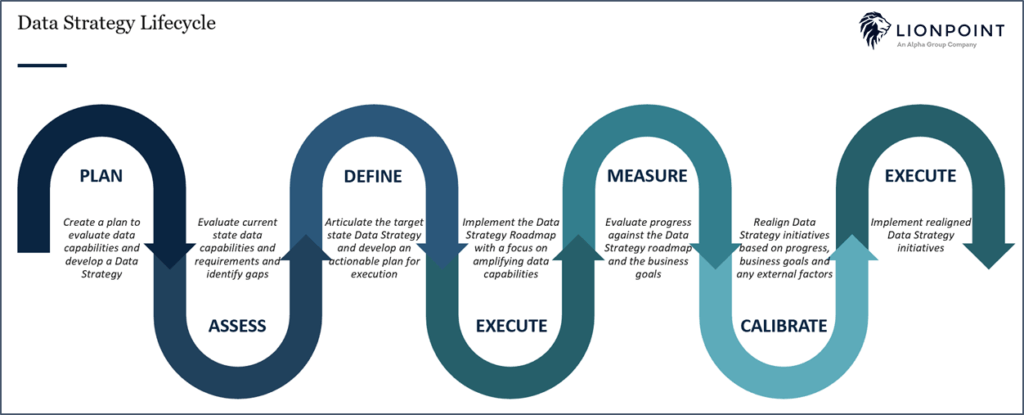

- Measurement & Calibration: Data programs should be on ongoing endeavors in which performance is continually measured and direction is calibrated against current progress and requirements.

This graphic and its contents are the intellectual property of Lionpoint Group and may not be replicated or disseminated without the expressed written consent of Lionpoint Group or Alpha FMC.

With these considerations accounted for, as well as an awareness of the capabilities required to support a robust data program and of the complexities inherent in the Real Assets industry, organizations can get much closer to realizing the value of their data as an asset.

While most Real Assets organizations have begun the data journey, few have managed to cross the data divide just yet, though they have achieved varying degrees of data maturity. However, the urgency to build robust data capabilities in order to develop a competitive advantage is increasing and many organizations are sharpening their focus on taking their data programs to the next level. Where do you sit on the data divide, and have you determined what it will take to shrink the gap?

If you would like to better understand or develop your organization’s data capabilities, Lionpoint has a team of experienced, expert consultants specializing in Real Assets with deep experience designing, implementing and evaluating data capabilities from Data Culture through to Data Platform.

For North American organizations, please contact Marlena Badway at mbadway@lionpointgroup.com, while Europe-based firms should email Hannah Holt at hholt@lionpointgroup.com.