A Liquidity Conundrum from Silicon Valley Bank: How to turn Treasurers into Champions

March 21, 2023

While bank runs are an inherit risk within the industry, there are key steps that can be taken to ensure resilience and preparedness when facing a situation like that of Silicon Valley Bank

As the dust settles over the collapse of Silicon Valley Bank (SVB), finance and treasury departments at other banks are scrambling to prevent a similar fate.

Pressures to improve balance sheet modeling, cash flow forecasting, and stress testing scenarios have been mounting for banks across the globe in the wake of SVB’s fall. These challenges stretch beyond regulatory compliance and highlight the need to consolidate all organizational risk types into one centralized model that can perform rapid scenario analysis. While bank runs (i.e., when numerous depositors pull out funds at a rapid rate) are an inherit risk within the industry, there are key steps that can be taken to ensure resilience and preparedness when facing a situation like that of SVB.

Consolidated Risk Models Across the Bank

From the aftermath of the 2008-2009 financial crisis until now, banks have established rigorous processes for creating and monitoring stress testing scenarios across the firm. Each model is deeply complex and provides business unit leaders with the information needed to run a successful operation. Where teams often fall short is in providing leadership with a consolidated view of interest rate, credit, and liquidity risk—often, these risk types are siloed and not presented in a holistic format. Such views would provide decision-makers with necessary information for understanding business implications of each stress and impacts to other areas of the organization. Quoted in the The New York Times, former Fed governor Lael Brainard said, “the crisis demonstrated clearly that the distress of even noncomplex large banking organizations generally manifests first in liquidity stress and quickly transmits contagion through the financial system.”

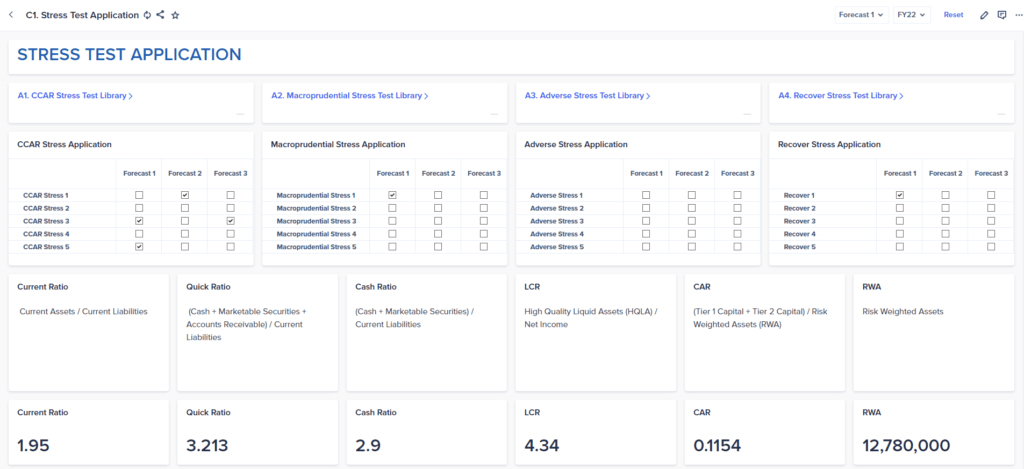

Captured from Anaplan

This may, at first, come across as abstract—however, we are on our way to establishing a new norm. To achieve this, organizations must leverage technologies that are robust and flexible. In Lionpoint’s Enterprise Performance Management (EPM) practice, we have configured a market-leading business modeling platform, Anaplan, to meet many of the modern challenges/risks faced by banks. Executives are provided a holistic view of their Firm’s financial health by leveraging Anaplan to create an aggregate view of the (often siloed) stress testing outputs. Additionally, Anaplan can seamlessly layer macroeconomic adjustments to stressed model outputs to show the impact of specific decisions across each risk type.

This consolidated view provides treasury departments with the data needed to rapidly respond to market changes. In the case of SVB, the siloed approach limited leaderships’ visibility into the relationship between interest rate and liquidity risk. By using Anaplan, banks can prevent siloed reporting and have a more complete understanding of how interconnected various risks in the market are.

Optimize Capital Lifelines

While yes, it is inconvenient to manage more than one subscription line or credit facility (less so for those with a quality Treasury Management System), it is entirely catastrophic to be without that important capitalization lifeline in times of need. As was noted with SVB, the bank had many high-quality, liquid assets—however, it did not have an effective way to convert assets to cash without suffering extreme losses. For SVB, this is due primarily to the lack of securities financing capabilities.

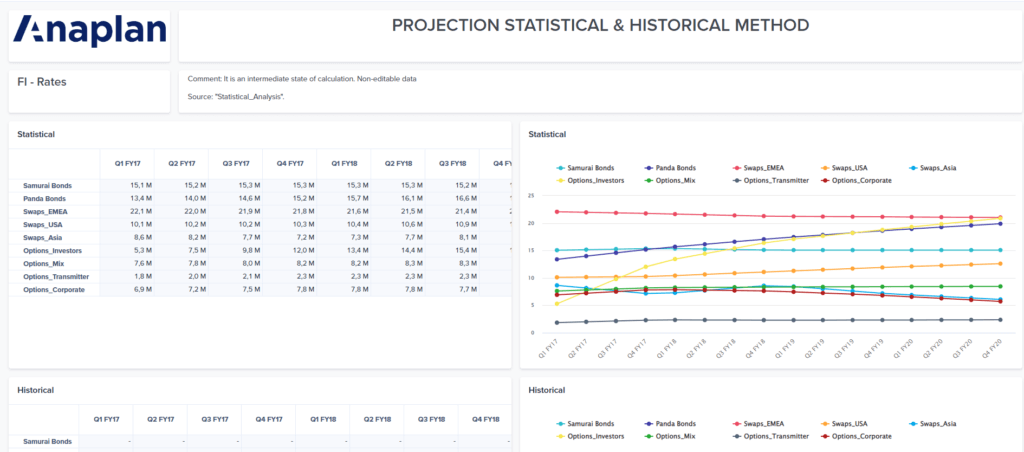

Captured from Anaplan

Banks benefit from having multiple securitization facilities that can be leaned on to meet payment obligations in times of stress, while also optimizing the utilization of said facilities. Enter, Anaplan.

Anaplan is a powerful modeling engine with built-in optimization capabilities. This functionality has proven to aid treasury departments in determining optimal methods of meeting funding and liquidity challenges, as well as complying with intricate covenant agreements. Utilizing a tool like Anaplan, banks can rely on real-time data to make informed decisions on where to secure capital while reducing the risk of a fire sale.

Gain the Ability to Quickly Pivot

SVB’s failure was unprecedented in terms of how quickly depositors withdrew cash and the bank collapsed—something that is starkly different from the bank runs of the past.

Social media and impulsive psychological behaviors of investors/customers are key factors impacting the speed by which SVB’s situation escalated from bad to worse. Because of digital communication/digital banking, customers were able to accelerate withdrawals at a pace not seen in recent memory.

“This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor at Restive Ventures, told CNBC in this article. “This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face.”

What happened with SVB has become a valuable lesson to banks regarding how quickly they must analyze adverse and severely adverse scenarios to prepare for times of unprecedented turmoil.

Captured from Anaplan

The speed of market changes has made traditional approaches to modeling obsolete. By the time a treasury department has finished updating cumbersome spreadsheets, it is often too late to make real-time impact. For this reason, banks are turning to technologies like Anaplan to iterate rapidly through tailored scenarios in minutes, instead of the hours/days most teams are so accustomed to. Being able to model numerous outcomes and compare results quickly is a critical necessity in the digital age. Armed with the most accurate information, leadership can then identify optimal paths to resolution and communicate these plans confidently, both internally and externally.

Next Steps

Firms are scrambling, yet again, to solve new issues emerging from the latest banking crisis. Banks can turn treasurers and risk professionals into business champions by equipping them with better tools and expertise, like Anaplan and Lionpoint consultants. With more optimal, real-time data at leadership’s fingertips, mitigation of emerging and evolving risks is no longer reactive, but proactive.