Leading private equity partners recently announced a new initiative to drive a standardized set of ESG (Environmental, Social and Governance) benchmarks to allow for focused reporting and increased comparability.

What has happened?

Leading private equity partners recently announced a new initiative to drive a standardized set of ESG (Environmental, Social and Governance) benchmarks to allow for focused reporting and increased comparability. Led by the California Public Employees’ Retirement System (CalPERS) and investment firm Carlyle, the initiative aims to consolidate an overview of an area of ESG reporting troubled by an ever-growing number of frameworks, which in turn leads to the inconsistency in reporting.

Research has shown an effective ESG policy can increase the value of a company by 5.5%. By setting an initial six metrics in scope, the initiative provides an accessible starting point for organizations who have previously been unsure of where to start. Additionally, the data will be consolidated by the Boston Consulting Group (BCG), to provide an anonymized benchmark – a feature that has been historically absent in ESG reporting. GPs should be encouraged to discuss requirements with their LPs to ensure they are aligned in direction for this reporting – setting a baseline early means that incremental improvements over time will less burdensome and will allow for a more transparent relationship.

The Six ESG Metrics to Know

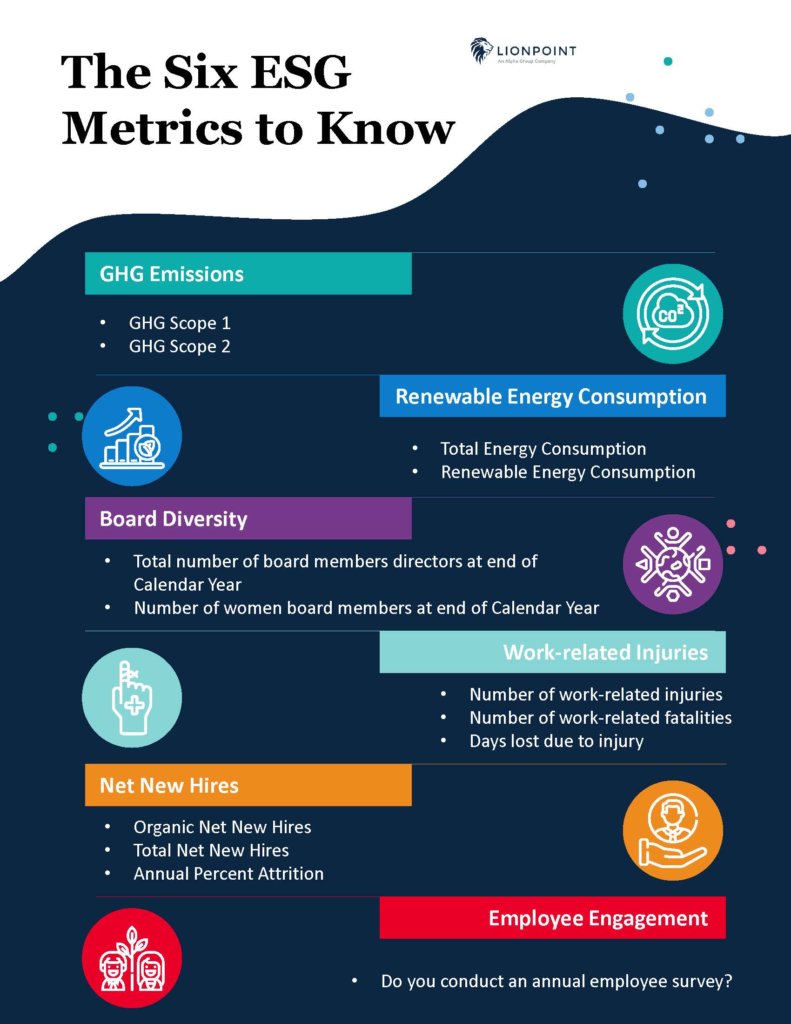

The six metrics identified as being required by the initiative for the first phase are as follows:

-

GHG Emissions

- GHG Scope 1 – Direct emissions due to owned, controlled sources accounted for using GHG Protocol

- GHG Scope 2 – Indirect emissions due to purchase of electricity, heat, steam, etc. accounted for using GHG Protocol

-

Renewable Energy Consumption

- Total Energy Consumption – The scope of energy consumption includes only energy directly consumed by the entity during the reporting period.

- Renewable Energy Consumption – Total renewable energy consumed from: geothermal, solar, sustainably sourced biomass (including biogas), hydropower and wind energy sources

-

Board Diversity

- Total number of board members directors at end of Calendar Year – Number of people on board of directors at end of year

- Number of women board members at end of Calendar Year – Number of women on board of directors at end of year

-

Work-related Injuries

- Number of work-related injuries – Total number of injuries, as defined by local jurisdiction, within the last calendar year.

- Number of work-related fatalities – Total number of fatalities as defined by local jurisdiction, within the last calendar year.

- Days lost due to injury – Total days lost due to work-related injury

-

Net New Hires

- Organic Net New Hires – New hires (the number of FTE joining the company, excluding hires that result from M&A) less attrition the number of FTE leaving the business) during a given calendar year

- Total Net New Hires – New hires (the number of FTE joining the company, excluding hires that result from M&A) less attrition (the number of FTE leaving the business) plus changes due to M&A (the net change in employees due to M&A) during a given year

- Annual Percent Attrition – Attrition (the number of FTE leaving the business) over the course of the year divided by average FTEs in previous year multiplied by 100

-

Employee Engagement

- Do you conduct an annual employee survey? – Y/N response indicating whether a company issues an annual employee feedback survey.

More importantly, these metrics identify an achievable initial platform on which to base further expansion into more material observations.

Why this matters

Since the launch of the Global Reporting Initiative (GRI), first published in 1999, a number of other frameworks have been released, such as the Climate Disclosure Project (CDP), the Climate Disclosures Standard Board (CDSB), the International Integrated Reporting Council (IIRC), the Sustainability Accounting Standards Board (SASB), and the Taskforce on Climate-related Financial Disclosures (TCFD). While conceptually each framework was introduced to encourage and measure the effects of ESG impacts in investing, each has fundamental differences in the way they approach the impacts of relevant areas, not least in terms of materiality, i.e., what is the object being affected and to what extent? In effect, there has been differences in identifying which metrics are relevant for which companies (or which industries).

Perhaps the framework generating the most alignment has been the Sustainable Development Goals (SDGs) however even these have posed issues in the sometimes conflicting interests resulting from different goals and the general lack of accountability. This has resulted in an unclear direction for GPs & LPs on how to focus their efforts – often resulting in internally designed standards which further separates the industry from a single source of truth. Regulatory efforts haven’t necessarily been introduced much more smoothly with the Sustainable Finance Disclosure Regulation (SFDR) introducing further concerns around data

The new ESG Data Convergence Project, drawing from frameworks such as those above as well as the World Economic Forum (WEF), International Labour Organization, and the Occupational Safety and Health Administration (OSHA), provides the ability for a truly universal alignment across entire industries and while it is still in its infancy, it proves a step in the right direction.

What should I do next?

For those investors already collecting ESG metrics, this is an opportunity to align their current collection requirements with the new standards and contribute to the industry benchmarks providing consistency and clarity to an opaque market. Data collection, at its core, is just a part of a wider data management strategy so it’s important to align the next steps with your current strategy. If there is an ESG data collection already in place it is worth reviewing the current scope to include the aforementioned metrics. There is obviously still an aspect of materiality to be considered, for example, a professional services firm will have a largely immaterial impact on greenhouse gas emissions but will see significant input on net new hires and employee engagement.

For those GPs or LPs not currently collecting ESG information, there are some areas that are more immediately accessible, such as tracking Net New Hires and Employee Surveys, and others less so, such as the calculation of GHG Emissions or use of renewable energy.

Lionpoint, in partnership with Alpha FMC, can work with organizations to identify the data points required across their firm – assisting in the selection of vendors, services or technology to aid in collating their ESG data. ESG and Strategy are becoming intrinsically linked at firm and fund-level. Contact us to help you integrate ESG into your wider firm, rolling out an effective solution in a seamless and scalable way to meet the ever-increasing ESG disclosure requirements.

References:

- Crifo, P., Forget, V.D. and Teyssier, S., 2015. The price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. Journal of Corporate Finance, 30, pp.168-194.