With more people withdrawing their Australian Super funds due to covid-19 related financial hardship, it’s even more important that fund managers ensure investment portfolios are prepared for future scenarios.

Lionpoint partners with Anaplan to enable organisations with scenario planning and forecasting capabilities.

by Shreyak Garg, Senior Consultant and Master Anaplanner at Lionpoint

Superannuation is an important and integral part of every Australian’s working life. Since being established in the 1980s, the ‘Super’ industry has gone through multiple reforms and legislations to become an essential retirement planning instrument.

As of June 2020, APRA indicates that this industry has now become a giant behemoth with almost $3 trillion of AUM.

Even before the pandemic, the superannuation industry was receiving heavy scrutiny from the Banking Royal Commission. However, much like the acceleration of industry trends from bricks and mortar stores to online marketplaces, the pandemic has put more focus on Super funds as members are allowed to withdraw from their retirement savings in order to deal with the financial hardships of covid-19.

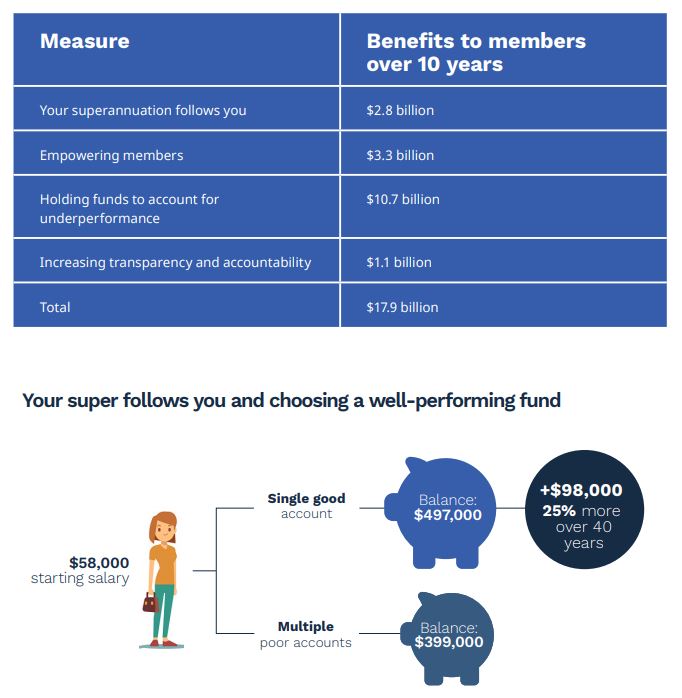

The APRA report recently estimated the withdrawals to be around $34.4bn with more than 3.3 million members having transacted out of their retirement nest egg. Superannuation was therefore a key highlight of Federal Budget 2020. Treasurer, Josh Frydenberg, announced the ‘Your Future, Your Super’ package as part of Budget 2020, aimed at increasing transparency and governance of Super funds, while easing the management of retirement savings for the members.

Key elements of the package include:

- One Account for life: A single account per person that would follow them throughout their various jobs across life. This would limit duplicate fees, insurance premiums and avoid unnecessary resources spent by super funds on maintaining these duplicate/dormant accounts. This is expected to boost super balances by $2.8bn in the next decade.

- Annual Performance Test: An APRA supervised annual performance test for all Super funds will be conducted. Members of funds that fail this test and underperform will be notified and prompted to make a choice of switching. Also, persistent underperforming funds for two straight years will not be allowed to take new members. This will push Super funds to perform consistently better while charging lower fees.

- Transparency and Accountability: Super Funds will be obligated to take actions in the financial interests of the members. Funds will also need to disclose key information about their operations at the AMM.

The first phase of these reforms will commence in July 2021.

Another key trend in the industry is investing ethically and considering sustainability, especially with Gen Z members’ preference towards investments that give careful consideration to a socially responsible investing (SRI) mindset.

A 23-year-old member recently took his Super fund to court over their handling of investments without considering the impact on climate and the court ruled in his favour. This also led to the super fund committing to manage investments that have net-zero climate emissions by 2050.

With stronger governance and scrutiny following the industry, Super funds will need to manage their portfolio of investments in a more efficient and agile way. The Super Guarantee which is expected to shoot up to 12% by 2025 will only provide more capital to these funds to manage. These funds will require a platform that allows investment managers across the organisation, geographies and cultures to be able to plan and monitor each investment throughout the holding journey and review key metrics like NAV, Costs and Expenses, Valuations etc. The platform will need to allow collaboration between investment managers so that they can learn from each other and help the fund grow its AUM over time, without compromising on the ability to restrict access to sensitive investment planning information.

Enter ‘Anaplan’

Anaplan is a cloud based connected planning platform that allows organisations to manage their investment portfolios and plan for scenarios such as covid-19.

Anaplan is a perfect solution for the Superannuation industry due to the following reasons:

- Portfolio Monitoring in a Connected Ecosystem

Anaplan provides a scalable connected planning ecosystem where organisations can setup data streams from multiple source systems, combine and consolidate this data for deeper analysis, scenario modelling, snapshotting and generating asset/portfolio valuations using a click button approach.

- Risk Analysis and What-Ifs

With Anaplan, asset and portfolio managers can perform sensitivity analysis and review KPIs across the portfolio such as ROI, IRR and slice/dice data by geographies, industry sectors, investment strategy and individual investments. This allows investment managers to make an informed decision and provide a strategic direction to the fund’s future investments.

- Marketing, Corporate Planning

Anaplan’s connected planning ecosystem allows the data to be leveraged and reused for modelling internal administrative aspects of a fund such as costs and expense planning, setup and monitor marketing plans. It gives the fund executives insights into how the fund is performing compared to similar sized peers and where efficiencies can be achieved to benefit the members.

- Benchmark Analysis

Anaplan allows reporting of investment performance by asset classes against the benchmarks as set by APRA which would allow the super funds to make informed investment planning decisions in the interest of members. Having a central platform for benchmarking can also lead to investment managers focussing more on investments that haven’t been performing up to the standards and identify key issues.

- Fees Analysis

Fund managers can review Operating Fees, Advice and Investment management costs across the portfolio with the capability to drill down and review the makeup of these costs over time. Such a detailed breakdown using Anaplan will allow super funds to review margins on the investments and provide better returns to members while charging lower fees over the long term.

- Cloud based 24×7 environment

With covid-19 accelerating the work from home trend, it is never more important for investment managers to have real time access to review and manage the portfolios from across the globe. Most super funds also have managers and investments across multiple continents. Setting up access for them in a legacy on-premise requirement is going to require huge IT investment compared to Anaplan where new users can be on-boarded just by a click of a button.

- Mobile and Excel Based Integrations

For super funds still leveraging Excel spreadsheets for portfolio tracking, Anaplan allows data to be accessed using an Excel plugin. This allows users to stay and work within the comfort of the Excel interface while leveraging the power in-memory cloud computing engine to perform calculations in real time.

Anaplan recently refreshed its interface and launched the New UX. The New UX apps are compatible across desktop using any web-browser and can also be accessed from handheld mobile devices that utilise iOS or Android.

- Corporate Reporting Integrations

Anaplan’s API integrations and partnerships with industry leading technology platforms will allow Super Funds to leverage BI platforms such as Tableau and PowerBI for enhanced visualisations and build real time, automated executive reports and periodic statements in Workiva that can be set according to the Fund’s brand guidelines and APRA’s requirements.

Summary

Lionpoint provides operations transformation and technology enablement services for private markets organizations, across the front, middle and back office. With deep industry experience and a team of experienced consultants, Lionpoint has been helping investment organisations move to new ways of analysing, managing and forecasting their business and investment performance.

provides operations transformation and technology enablement services for private markets organizations, across the front, middle and back office. With deep industry experience and a team of experienced consultants, Lionpoint has been helping investment organisations move to new ways of analysing, managing and forecasting their business and investment performance.

As an established and experienced Gold Partner of Anaplan, speak to us about Anaplan’s scenario planning and forecasting capabilities for your organisation.

Author

Shreyak Garg

Senior Consultant

sgarg@lionpointgroup.com

Connect on LinkedIn

Nick Moore

Founder & Executive Director

nmoore@lionpointgroup.com

Connect on LinkedIn

References

Annual Report 2018 – 2019 – AustralianSuper

ABC News: Rest super fund commits to net-zero emission investments after Brisbane man sues, Nov 2020