AI Strategy for Builders: Debunking the supermodel architecture myth to provide practical solutions for investment companies

Our whitepaper explores essential facets of AI strategy development for investment companies, addressing prevalent misconceptions and key implementation challenges. Through an illustrative scenario involving a private equity firm, we provide insights into overcoming these hurdles effectively.

Our Predictions for the PE Industry – 2023 in Retrospect & 2024 Outlook

Last year we published 6 predictions for the PE industry in 2023, available here. On the one hand, we predicted fundraising difficulties, and a general pullback from Leveraged Buyouts. On the other, we foresaw a sustained interest in LP-led & GP-led secondaries, particularly continuation funds, and scope for larger, diversified GPs to home in on their yield-generating businesses, such as Credit & Real Assets. Now we revisit these predictions in retrospect and cast our eyes forwards for 2024.

Navigating the Future: Enhancing Knowledge Management in Private Markets

In the dynamic landscape of private markets, where rapid innovation and evolving market trends redefine success, fund managers find themselves facing the critical challenge of efficiently managing and leveraging data and knowledge across their firms and portfolios. Fund managers are on a quest to not just accumulate information but to harness actionable insights - i.e. leverage their experience.

How Chronograph and Lionpoint Help Private Market Investors Leverage Data as a Competitive Edge

In today's dynamic private investment landscape, the decision to build, buy, or outsource reporting and visualization tools isn't just a technical choice; it's a strategic pivot that defines an investment firm's agility, growth, and competitive edge. Delve into the distinctive advantages and complexities of each path, revealing fresh approaches to enhancing returns while managing costs.

Architects of Advantage: Mastering Investment Strategy through Building, Buying or Outsourcing

In today's dynamic private investment landscape, the decision to build, buy, or outsource reporting and visualization tools isn't just a technical choice; it's a strategic pivot that defines an investment firm's agility, growth, and competitive edge. Delve into the distinctive advantages and complexities of each path, revealing fresh approaches to enhancing returns while managing costs.

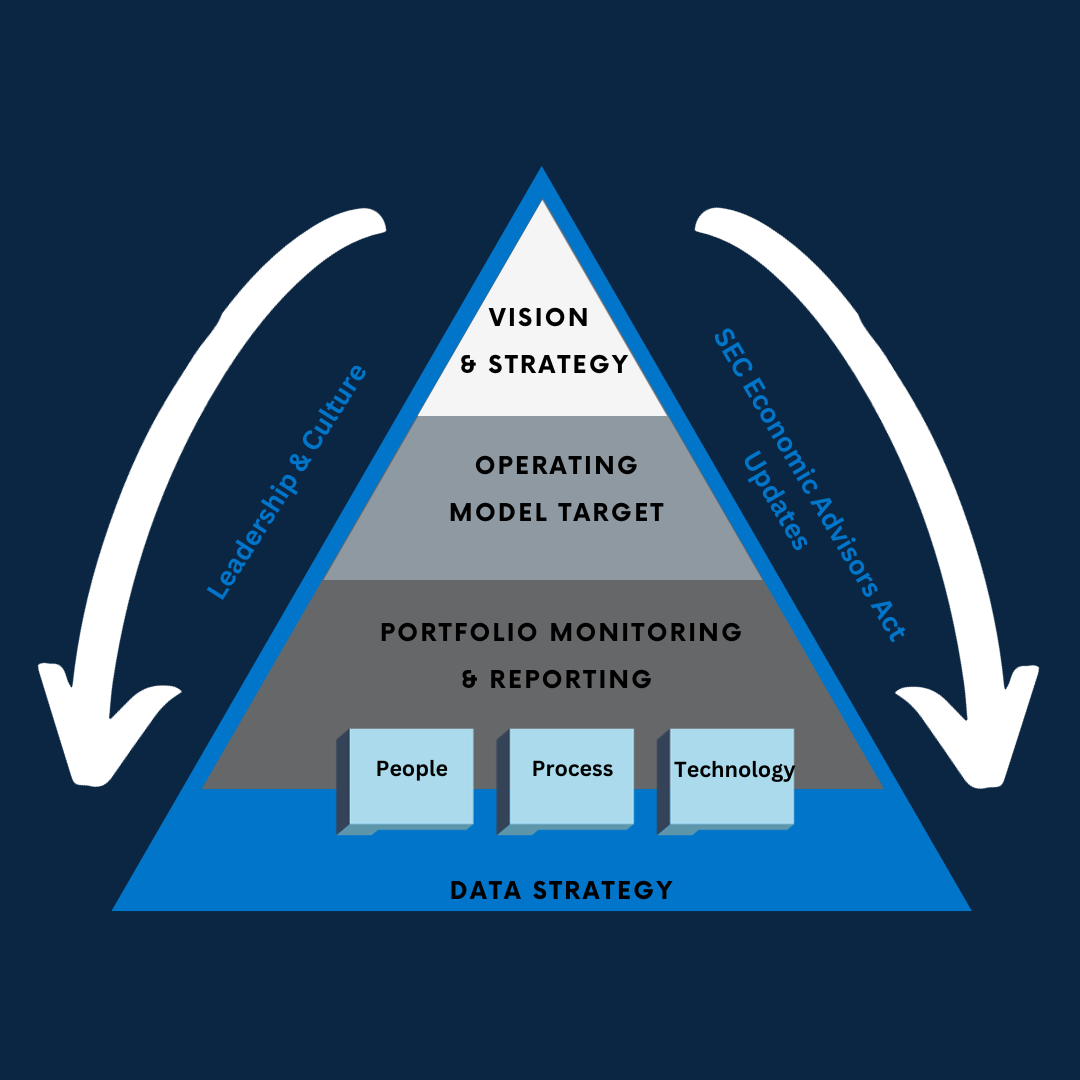

Elevating LP Portfolio Oversight Amid Updated SEC Transparency Regulations

The SEC introduced new rules to increase transparency and fairness in the private funds market. This regulatory shift emphasizes the importance of transparency, and in response, Limited Partners can improve their portfolio monitoring through data strategy, technology adoption, and operational excellence.

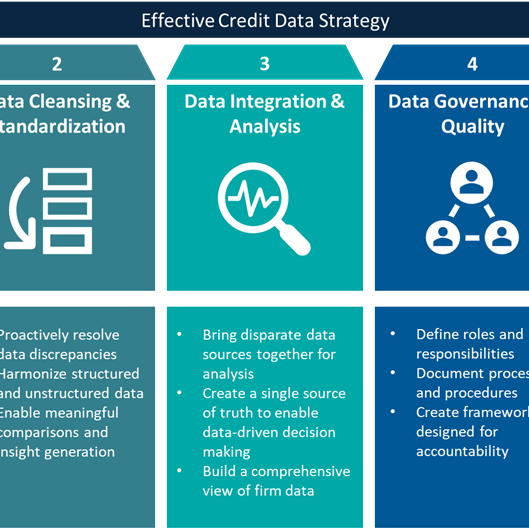

5 Key Elements of Data Management in Private Credit

In the realm of private credit, data plays a vital role in shaping investment decisions and risk assessment. This article highlights 5 key data management elements, examines challenges within each, and discusses their significant influence on the success of private market firms.

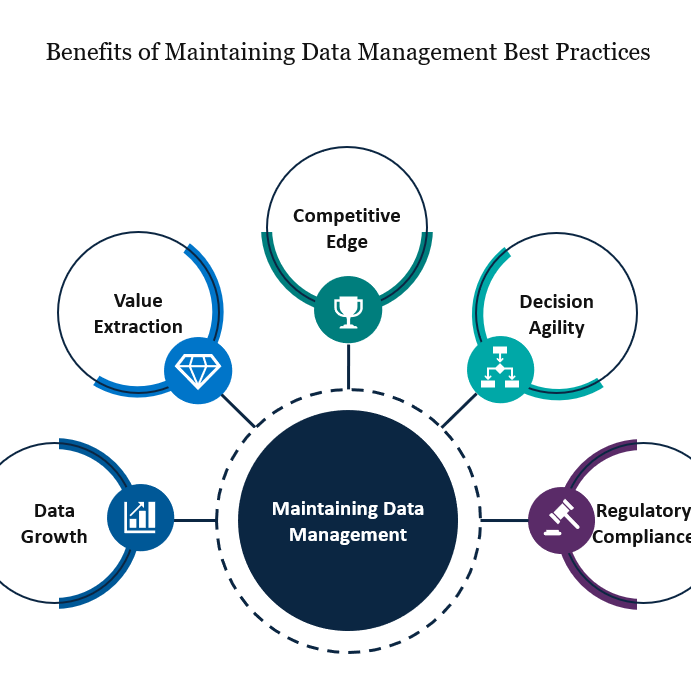

Unleashing the Power of Data: Maintaining a Robust Data Strategy

In the ever-evolving landscape of modern business, data management stands as a critical pillar for organizational success. To remain competitive and agile, companies must recognize the imperative of continuous improvement in their data management practices.

Navigating NAV Loans

Introducing the world of NAV Loans: Collateralized by a private equity fund's net asset value (NAV), these loans offer liquidity and growth opportunities, with the market expected to reach $600 billion by 2030. While advantageous in various scenarios, it's essential to consider potential risks and leverage advanced technology like Anaplan for accurate monitoring and risk assessment.

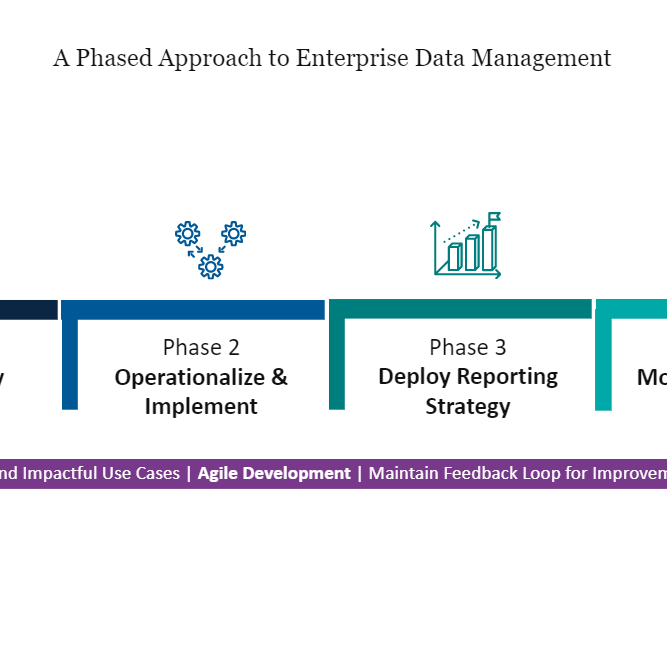

Unleashing the Power of Data: Putting the Plan into Action

Implementing a data strategy is crucial for organizations to thrive in today's business landscape. It offers numerous benefits, including improved decision-making, operational efficiency, and the ability to leverage data as a strategic asset.

Resourcing in private markets: Choosing the right service model

Co-sourcing emerges as a viable solution for private equity firms seeking the benefits of outsourcing fund administration while maintaining real-time data access and control over their core systems. The model allows leveraging fund administrators' expertise and resources, while retaining scalability and integrated technology infrastructure.

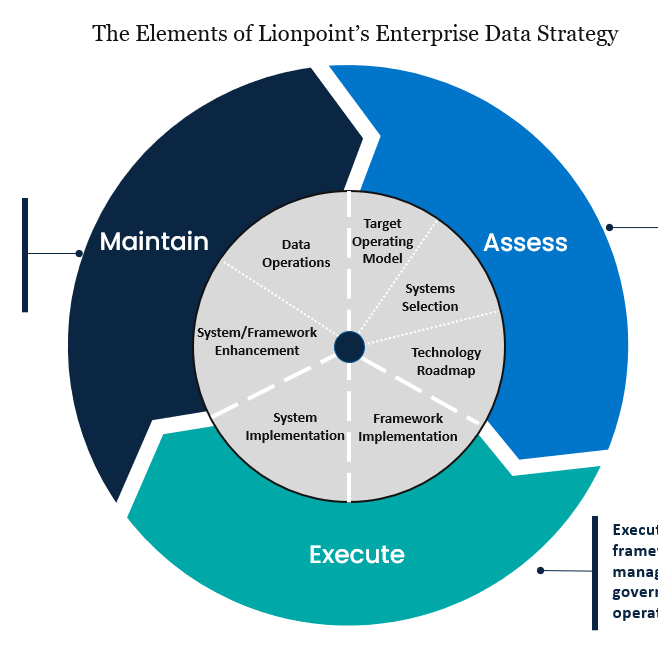

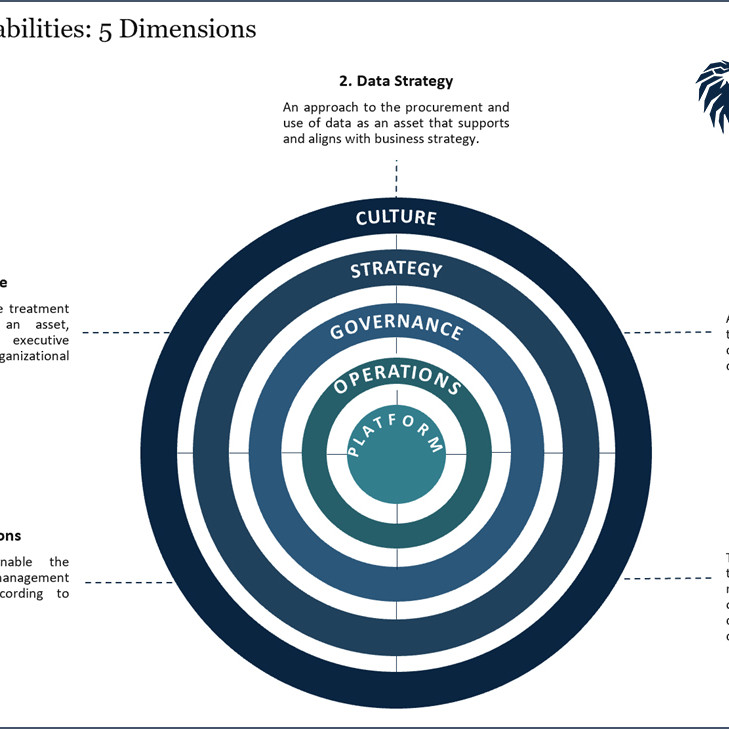

Unleashing the Power of Data: Building a Foundation

Performing a data strategy assessment is crucial for private market firms aiming to develop a comprehensive data strategy. By identifying gaps, prioritizing investments, and developing a data roadmap, firms can achieve their data management goals effectively.

Liquidity Management: Insights from March’s financial turmoil and 3 Key Lessons for Private Markets firms

With private markets firms leveraging banks as a source of working capital, they are particularly vulnerable to the impact of banking failures. In this article, we discuss some proactive steps that can be taken for firms to get ahead of the curve and safeguard themselves from institutional risk.

Unleashing the Power of Data: The Competitive Edge for Private Markets

Leveraging data as a vital, differentiating asset is crucial for organizations to uncover opportunities and optimize operational efficiency. Within private markets, firms that have a clear data strategy are best positioned to capitalize on their data and wield information as a source of competitive advantage.

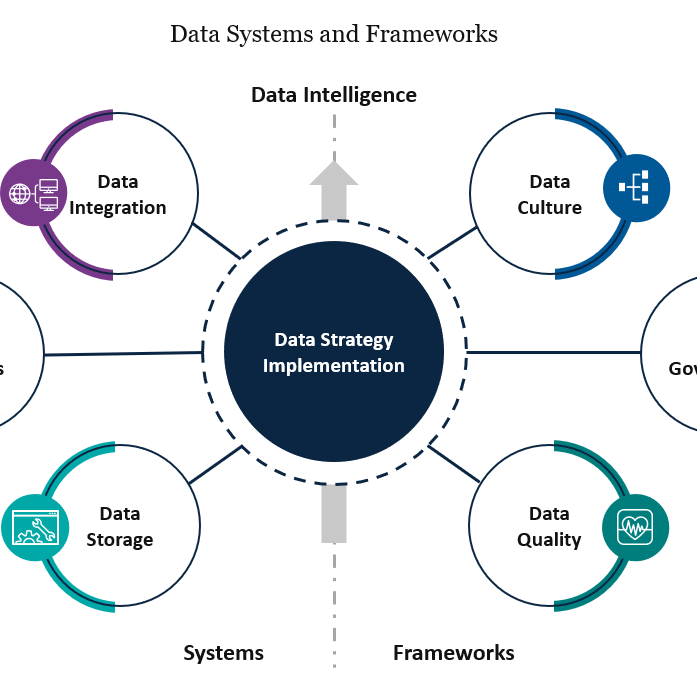

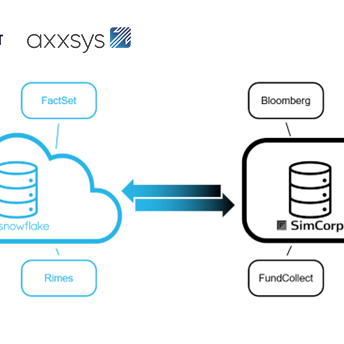

How Technology like Snowflake and Simcorp Dimension Can Optimize Data Warehouse Storage

Scaling resources on-the-fly is a key benefit of a cloud data warehouse. By elastically adjusting to the needs of your organization, users only pay for the computing power and storage used.

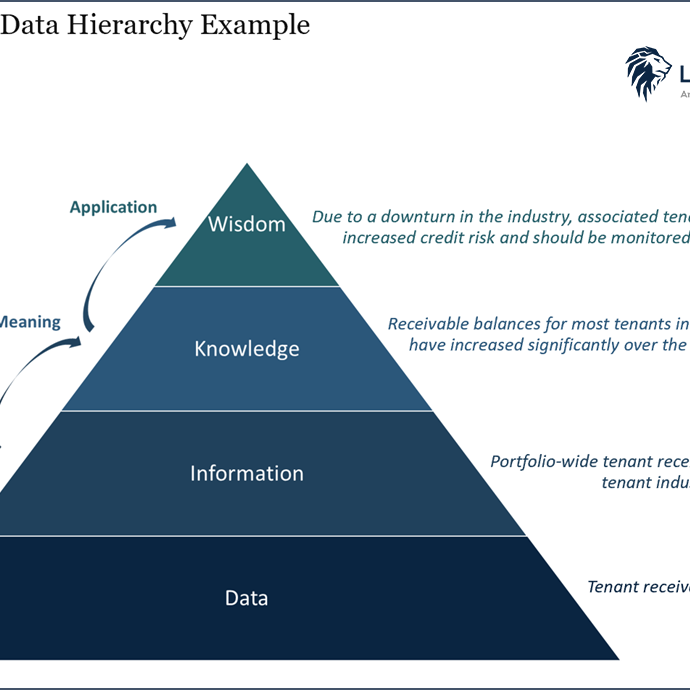

Real Assets Technology Strategy Part III: Actionable Insights, Turning Data into Wisdom

If organizational data is to be viewed as an asset, how can Real Assets organizations realize and maximize the intrinsic value of their data assets?

A Liquidity Conundrum from Silicon Valley Bank: How to turn Treasurers into Champions

Lionpoint's Private Markets Advisory Team shares six predictions for the private equity space for 2023 and how to best assist GPs.

Why the Need for ESG Data is now a Part of a Winning Strategy in Private Equity

Lionpoint's Private Markets Advisory Team shares six predictions for the private equity space for 2023 and how to best assist GPs.

Six Predictions for Private Equity in 2023

Lionpoint's Private Markets Advisory Team shares six predictions for the private equity space for 2023 and how to best assist GPs.

The Cost of Tech Stagnation and How to Avoid It

What is the cost of digital stagnation? Here are four examples as compiled by Lionpoint Group and Nova

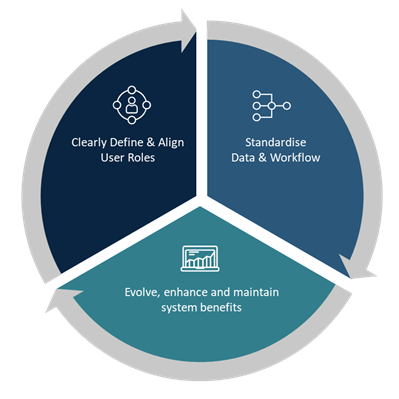

Real Assets Technology Strategy Part II: Implementing for Change

Technology implementation is a critical process and should be seen as an opportunity to enact real, positive change in the business.

Read the Report: Portfolio Monitoring Roundtable Findings

Lionpoint has hosted a series of roundtable sessions discussing Portfolio Monitoring (“PM”) across the Private Equity industry. The objective across the three sessions was to share experiences, both pain points and positive, and to engage in constructive discussion on the topic of PM, its technology, and its use cases.

Leveraging Data & Technology to Drive Real Results in Real Assets: Part I

Whether managers are focused on building resiliency to weather market instability, attracting new sources of capital, or demonstrating a strong ESG record, data is at the center of the strategies that will be required to address these critical goals.

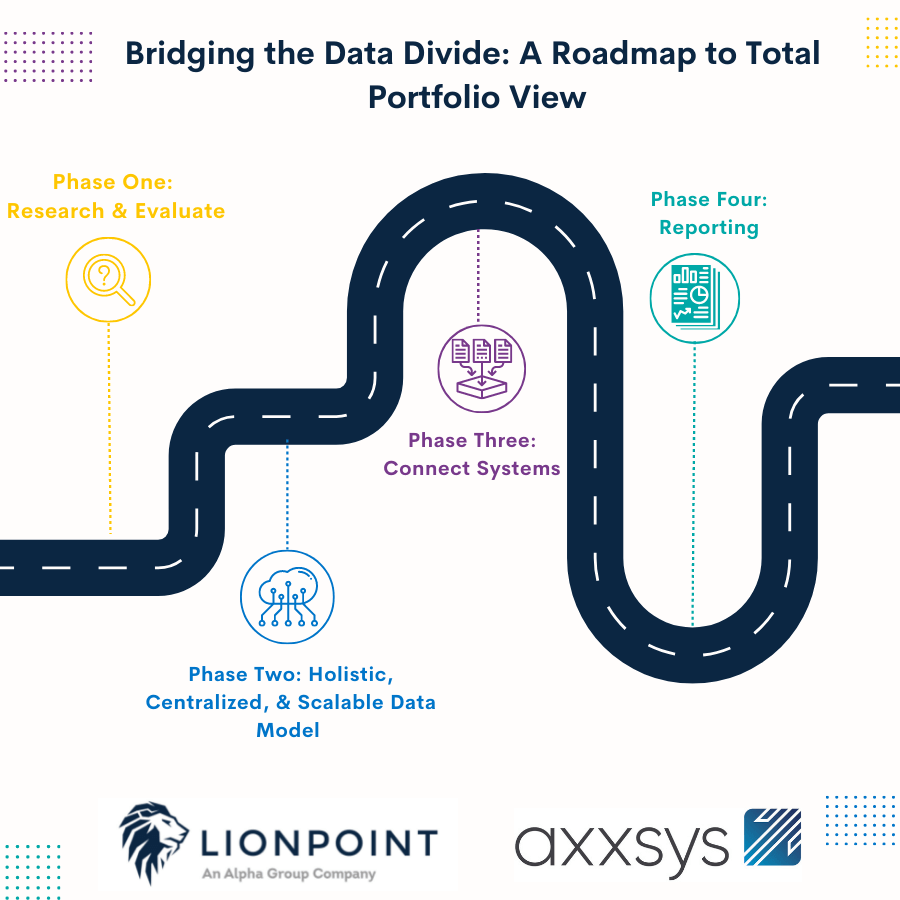

Bridging the Data Divide: A Focus on Total Portfolio View

A consolidated, firm-wide view can be leveraged to commercialize data and aid in compliance, exposure, risk, performance analysis, and enhanced decision making.

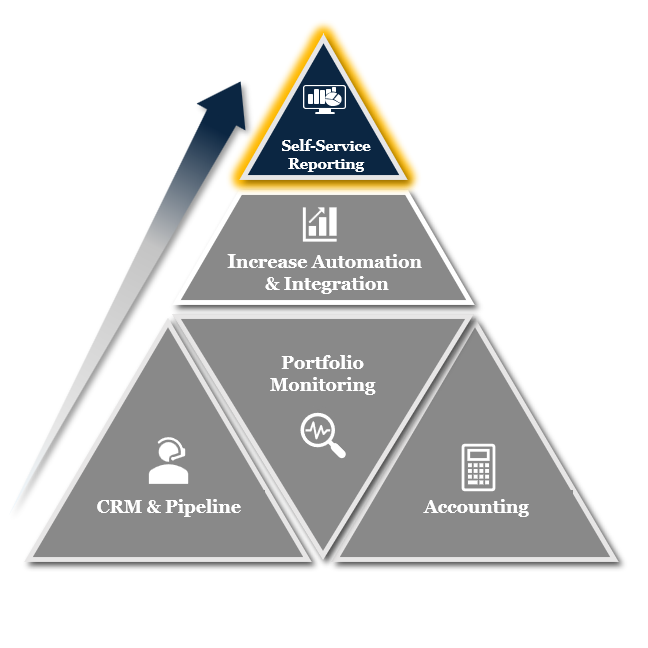

The Path to Successfully Implementing a Portfolio Monitoring System in Private Equity

Portfolio monitoring tools play a significant role in managing portfolio risk by improving performance and increasing transparency. Hence, careful consideration should be given while selecting the right tool to put in place.

Anaplan Best Practices: Process and Import IDs

When setting up data integrations in Anaplan, the process or import actions are often referred to by name. However, this practice isn't robust and can cause process failures if names are changed in the model.

How to Choose the Best Portfolio Monitoring System for Your Business

Portfolio monitoring tools play a significant role in managing portfolio risk by improving performance and increasing transparency. Hence, careful consideration should be given while selecting the right tool to put in place.

Watch: How Blackstone Utilizes Anaplan

Watch Lionpoint's Mitch Max speak with Blackstone and Anaplan in this panel on the rise of the agile finance organization

WATCH: Emerging Trends and the Role of Tech in Valuation & Reporting Webinar

Watch this webinar co-hosted by Lionpoint and 73 Strings including panelists from Vista Equity, WestCap Group and Blackstone.

How Will Inflation Impact Private Markets?

How resistant are private markets when it comes to inflation? Our experts examine how rates will effect decision-making and what could come next.

Leveraged Loans – How to Dig Yourself Out of the Data Abyss

Lionpoint Executive Director Bill McMahon sits down with LevPro Co-Founder and COO John Porges to discuss data challenges and solutions in the leveraged loan market.

A Second(ary) Wind: Why the Secondary Market is Surging in Private Equity

The perfect storm for private equity’s secondary markets to surge is taking shape.

Record levels of dry powder, liquidity pressures, new vehicles designed to focus on quality assets and a burst of data driven advances in technology are driving tremendous volume with no signs of slowing down.

How data visualization can be used to better communicate predictive analytics

Visual solutions chip away at the complexity of predictive data by acting as an interpretive tool, thus creating the perfect synergy

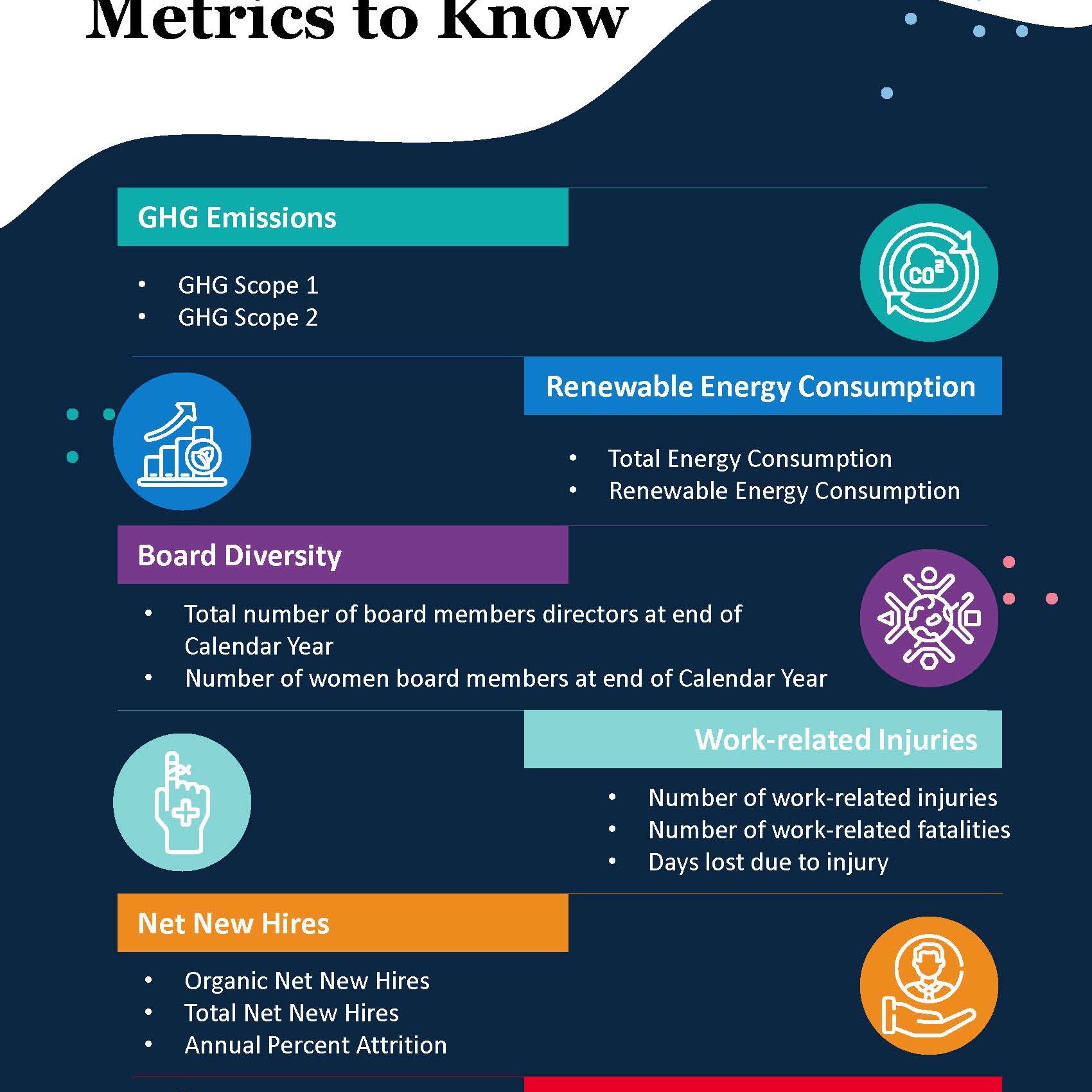

How New ESG Benchmarks Could Impact the Private Equity Sector

Leading private equity partners recently announced a new initiative to drive a standardized set of ESG (Environmental, Social and Governance) benchmarks to allow for focused reporting and increased comparability.

Interview with Jonathan Balkin for Private Equity Accounting Insights

Jonathan Balkin spoke to Mariya Stefanova for the release of the PEAI Carry Directory, a definitive guide to ‘all things carry’.

Why GPs Should Consider a Target Operating Model

Achieving operational efficiency has the potential to reduce costs, make clients happier and even improve investment returns.

How Private Markets GPs Can Improve Their Data Management

Firms can be more efficient and better informed if they improve their data management. If they do not, they may get left behind and lose clients. We discuss the best way to make their data better.

IHS Markit Educational Series featuring Lionpoint

IHS Markit's Educational Series covers important and timely topics for Private Markets with thought leaders throughout the industry. Lionpoint features in 3 episodes of this 7 part series.

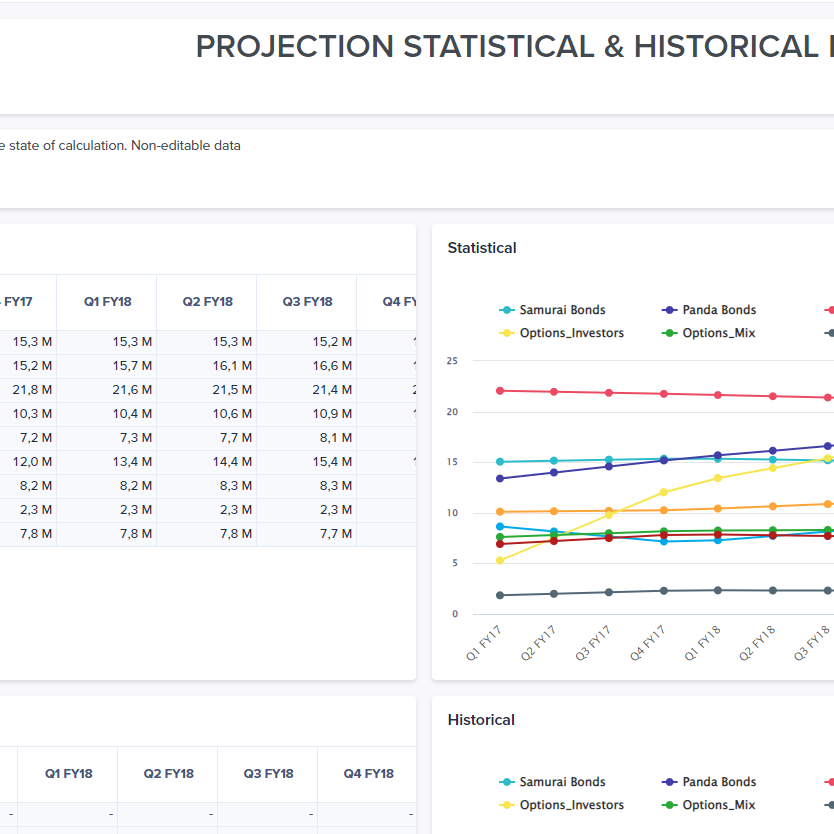

Fast Paced Changes Require Real-Time Forecasting

Nick Moore and Giles Travers share insights into the common challenges facing clients, and how Lionpoint is helping them gain more reliable data and real-time forecasting.

Essential Real Estate in 2021 and Beyond

Across four key areas, commercial real estate owners and investors are accelerating their digital roadmap and transforming operations to meet the challenge of covid-19, and a post-pandemic world.

Connected Planning for Logistics and Industrial Investments

Logistics real estate has come out on top during the pandemic, with changes to supply chain, delivery models, and increased investor demand. As asset managers navigate short-to-medium term business adjustments to sustain the pandemic, access to fast, reliable data is integral for value creation and deal-making.

In Conversation with Allvue: The Future of Fund Accounting

As GPs emerge from the Covid-19 crisis and begin to take stock of how best to move forward, Lionpoint and Allvue discuss technology’s ability to automate and improve a firm’s accounting processes.

Data Requirements Drive Middle Office Outsourcing for Private Equity

Lionpoint Director, Mike Tracy, and Co-founder & Executive Director, Jonathan Balkin, discuss the growing role and advantages of outsourcing for private equity firms in an interview with Private Equity Wire.

In Conversation with Allvue: How to Build a Data Strategy

An effective data strategy can meaningfully streamline and de-risk a GP’s processes, as long as it’s not hindered by an unintegrated tech stack, according to Travis Broad, Manager, at Lionpoint.

Scenario Planning and Forecasting for Australian Superannuation

With more people withdrawing their Australian Super funds due to covid-19 related financial hardship, it’s even more important that fund managers ensure investment portfolios are prepared for future scenarios.

Data Aggregation in European Real Estate Investment

Read about the adoption of technology solutions in the European real estate industry, as firms realize the power of data aggregation tools for reporting and querying.

Building Better, Faster Forecasts

Lionpoint Founder and Executive Director Jonathan M. Balkin, and Director Bill McMahon, spoke to Private Funds CFO about the dangers of working in silos, and how important it is for GPs to invest in cleaning up and consolidating data, for more accurate forecasting.

Business Intelligence and Reporting Excellence for Private Markets

The expectations of investors and regulators in private markets continue to increase. Lionpoint works with private markets clients to enable Business Intelligence, real-time data and manager and investor requirements for greater transparency into underlying portfolio companies and investment holdings.

Leveraging Anaplan for essential real estate asset, portfolio, and fund modeling in a rapidly changing environment

Henri Wajsblat, Anaplan’s Head of Financial Services Solutions, interviewed Anaplan Gold partner and Lionpoint Group Founder Nick Moore about the transformation of the real estate sector, its business and technology issues, and how the Anaplan platform and Lionpoint solutions can help.

Connected Planning and Its Impact on Commercial Real Estate

The U.S. Census Bureau recently released its retail and food services report for February. It highlighted, among other trends, that online sales gained a slight edge over brick-and-mortar stores (11.813% versus 11.807%)—one of many major milestones that represent the scope and scale of online shopping growth.