Successful and resilient planning is dependent on key capabilities, including accuracy, speed, flexibility, visibility, and collaboration.

Anaplan combines an unrivalled planning and modeling engine, predictive analytics, and cloud collaboration into one simple Excel-like interface.

Across all lines of a private capital business, including finance, investor relations, portfolio management, operations, executive committee planning and HR, Anaplan solutions connect performance data with business strategy and processes.

Lionpoint are Anaplan consulting partners with expertise across the following industries:

- Financial Services, Banking and Insurance

- Private Equity and Private Debt

- Real Estate and Infrastructure

- Hedge and Credit Funds

- Limited Partners

- General Partners

- Fund Admins

Anaplan Gold Partner

Lionpoint is a global Anaplan Gold Partner and a Global Certified Partner for alternative investments. Gold-tier status recognizes our Anaplan implementation partners’ ability to drive high-value transformation and deliver exceptional customer success with Anaplan consulting services.

Lionpoint is an expert Anaplan consultancy

95%

Anaplan Customer Satisfaction Score

250+

Client Projects

60+

Anaplan Consultants

Benefits of Using Anaplan Solutions

One of the key benefits of Anaplan is that it can be used across the entire organization, and not just in specific departments like finance. It can be used across multiple areas of your business, from operations to HR. This can help make collaboration and cooperation around the tool much easier and more seamless.

Anaplan is a powerful tool for dealing with large sets of complex data from multiple internal and external sources. It provides many benefits of a data warehouse, but is much easier to use and understand for a business user.

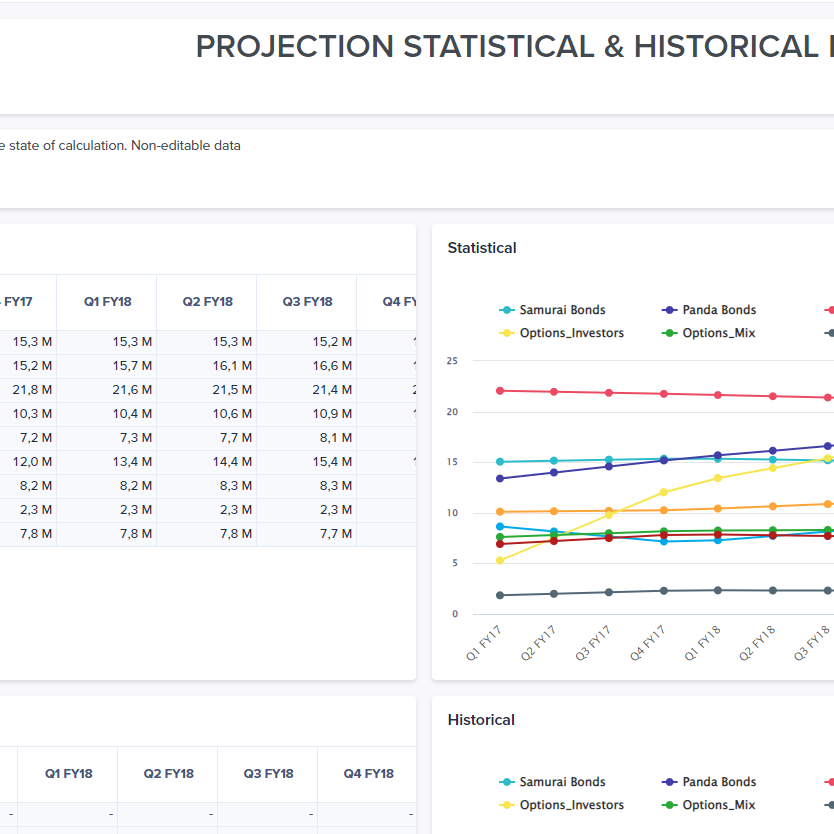

Compared to other spreadsheet applications like Excel, Anaplan has the processing power needed to work with large volumes of data. Organizations can also leverage Anaplan’s powerful data modelling and analytics tools for a variety of uses. These include budgeting, compensation planning, carry modelling, sale realization, and other forecasting applications.

Anaplan is also built for modern business thanks to its cloud-based architecture. This facilitates remote work for enterprises in hybrid and cloud environments. It also allows working with data from a centralized location.

One important benefit of this setup is that Anaplan allows you to see real-time changes in other business areas. You can, for instance, see how forecasts from the sales department can impact the cash flow and balance sheet of the finance team.

Lastly, Anaplan arms everyday users with the power to work with data and models – without the need for IT intervention. Once set up by an Anaplan expert, can create new models and scenarios, manipulate data, and forecast with confidence. This enables everyone in your organization to rapidly come up with the data necessary to make split-second decisions.

Of course, one of the biggest challenges of this powerful platform is setting it up. This is where Anaplan consulting partners can ease your transition, letting you experience the benefits much faster.

Anaplan works across your entire enterprise

Anaplan can plug into any existing ecosystem and integrate with many processes

Anaplan complements your existing technology stack

Anaplan is a cloud-based, scalable digital platform

Our Latest Anaplan Case Studies

How Partners Group Unlocked Scalable Growth in its Secondary Practice Through Anaplan-Driven Underwriting Innovation

As part of positioning its PEPI business for the next phase of growth, Partners Group wanted to develop a…

A Liquidity Conundrum from Silicon Valley Bank: How to turn Treasurers into Champions

Lionpoint's Private Markets Advisory Team shares six predictions for the private equity space for 2023 and how to best…

Anaplan Best Practices: Process and Import IDs

When setting up data integrations in Anaplan, the process or import actions are often referred to by name. However,…

Anaplan Use Cases within Financial Services and Asset Management Firms

Anaplan’s multi-dimensional platform has a wide range of use cases across financial services and the private markets. Its ease of use and flexibility allows it to be tailored to the requirements of the business. Solutions include:

- Real Estate Budgeting, Forecasting & Scenario Analysis: Full real estate lifecycle modeling and forecasting across all asset types and fund structures

- Waterfall Modeling: A scalable solution for GP/LP Waterfall calculations driven by LPA terms and presented at the investor level with waterfall amounts by tier

- Management Company FP&A: Streamline FP&A processes including Budgeting and Forecasting, Cost Allocations, What If? Scenario Analysis and Financial Reporting to allow for continuous planning and rapid decision making

- Workforce Planning: Integrate payroll data, open roles, and labor budgets in a collaborative workforce planning solution for HR, Finance, Recruitment, and across all Business Units

Private Markets Apps & Accelerators

Lionpoint has built accelerator apps to provide a springboard for alternative investment managers and investors. These include a private equity theoretical waterfall model, fund of fund and directs portfolio analytics and a real estate budget and forecasting model.

Anaplan Guides

Our Anaplan Guides provide an overview of Anaplan’s key uses by industry.